CAM Investment Grade Weekly Insights

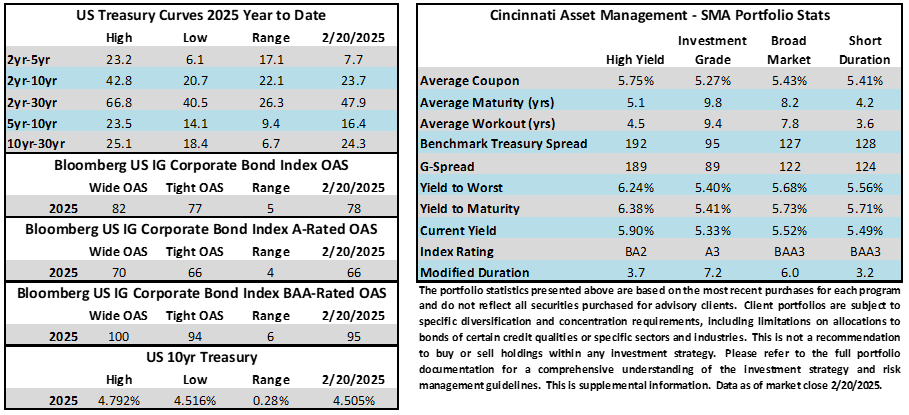

Credit spreads remained near their tightest levels of 2025 during the holiday shortened week. The option adjusted spread of the Bloomberg US Corporate Bond Index closed at 78 on Thursday February 20 after closing the week prior at the same level. The 10yr Treasury yield did not exhibit much change during the week and was 3 basis points lower on the week through Thursday evening. Through Thursday, the Corporate Bond Index year-to-date total return was +1.15% while the yield to maturity for the Index closed the day at 5.28%.

Economics

The highlight of an otherwise quiet week was the Wednesday release of the minutes from the January FOMC meeting. The minutes showed that the majority of policymakers believed that inflation was somewhat elevated and that they needed to see continued disinflation in order to be confident about the longer term 2% target. As of Friday morning, interest rate futures were pricing almost no chance of a cut at the March meeting which is just less than a month away. Futures were pricing in a 24% cut at the May meeting and a 41% chance in June. All told, traders are still expecting roughly 1.7 cuts before the end of this year (between 1 and 2). Recall that the dot plot released at the end of December showed a median expectation from the FOMC of 2 cuts in 2025. A new dot plot will be released at the March meeting.

Next week will be incredibly busy as far as economic releases are concerned. Prints that have market moving potential include GDP, Core PCE and Personal Income/Spending on Thursday and Friday.

Issuance

New corporate issuance handily topped the estimate of $40bln on the week with the finally tally coming in at more than $52bln. This was an especially impressive haul considering that the market was closed on Monday in observance of President’s Day. Concessions ticked higher this week as new issuers paid about 5bps for new bonds relative to secondary issues. Syndicate desks are looking for around $30bln of new supply next week as February comes to a close.

Flows

According to LSEG Lipper, for the week ended February 19, investment-grade bond funds reported a net inflow of +1.82bln. Total year-to-date flows into investment grade funds were +$14.2bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.