CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

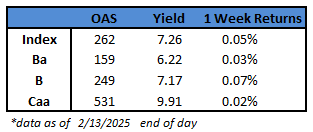

- US junk bonds snapped back on Thursday, notching the biggest one-day returns in a week after it became clear that reciprocal tariffs were not likely before April. Yields tumbled six basis points to 7.26%.

- The gains spanned across ratings. CCCs, the riskiest part of the high-yield market, racked up gains of 0.22%, the most in three weeks, after yields dropped eight basis points to 9.91%. Risk assets rallied across markets as stocks came close to their all-time highs.

- Undeterred by the heightened volatility and uncertainty around trade policy, bankers led by Morgan Stanley offloaded $4.7b of debt of X Holdings Corp, formerly known as Twitter, at par, tighter than early indications of 98 cents on the dollar. This was the third tranche in two weeks

- The high yield primary market priced two more deals, lifting the month’s supply to $13b

- Persistent yield-driven demand and still-intact fundamentals continue to underpin credit market stability, Brad Rogoff and Dominique Toublan at Barclays wrote on Friday

- Yields and spreads, though, moved in a narrow range this week amid daily uncertainty around tariffs and stubborn inflation data renewing concerns about Fed keeping rates higher for longer, disrupting steady growth

(Bloomberg) US Inflation Tops Forecasts, Bolstering Case for Fed to Hold

- US inflation picked up broadly at the start of the year, further undercutting chances of multiple Federal Reserve interest-rate cuts this year.

- The monthly consumer price index rose in January by the most since August 2023, led by a range of household expenses like groceries and gas, as well as housing costs. Excluding often-volatile food and energy costs, the so-called core CPI climbed 0.4%, more than forecast, fueled by car insurance, airfares and a record monthly increase in the cost of prescription drugs.

- Inflation tends to come in higher in January, because many companies choose the start of the year to hike prices and fees. That pattern has been exacerbated in the post-pandemic era, and several forecasters suggested that the jump in price growth last month won’t be repeated going forward.

- Still, Wednesday’s report from the Bureau of Labor Statistics serves as further evidence that inflation progress has at least stalled — if not in danger of being reversed. Combined with a solid labor market, it will likely keep the Fed on hold for the foreseeable future. Policymakers are also awaiting further clarity on Trump’s policies.

- “We saw strength across the board — whether you’re looking at energy, food, within core components — and so I think it points to a price environment that still remains difficult as far as the Fed is concerned,” said Sarah House, a senior economist at Wells Fargo & Co. “So for how long you expected the Fed to be on hold going into this report, I think this only lengthens that time frame.”

- Fed Chair Jerome Powell, speaking before the House Wednesday, said the latest consumer price data show that while the central bank has made substantial progress toward taming inflation, there is still more work to do.

- “I would say we’re close, but not there on inflation,” Powell told the House Financial Services Committee in response to a question on the second day of his semi-annual testimony to Congress.

- The January increase in the CPI was led by grocery prices, with two-thirds of that advance due to higher egg prices in the wake of a deadly bird flu outbreak. The more-than 15% jump was the largest since June 2015. Costs of hotel stays and used cars also climbed, possibly in the aftermath of severe wildfires in Los Angeles.

- The report incorporated new weights for the consumer basket to try to more accurately capture Americans’ spending habits, which resulted in minimal revisions to the CPI last year.

- Seasonal adjustments to January data were also minimal, and failed to offset the turn-of-the-year price hikes. As a result, “the sharp increase in the core CPI is less alarming than it first appears,” Sam Tombs, chief US Economist at Pantheon Macroeconomics, said in a note. “We recommend waiting for February’s data, when the new seasonal factors look set to dampen the seasonally adjusted index more than in previous years, before judging how the underlying trend has evolved.”

- Goods costs excluding food and energy rose by the most since May 2023. However, when removing used cars, the index was little changed.

- Policymakers also pay close attention to wage growth, as it can help inform expectations for consumer spending — the main engine of the economy. A separate report Wednesday that combines the inflation figures with recent wage data showed real hourly earnings grew 1% from a year ago.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.