CAM Investment Grade Weekly Insights

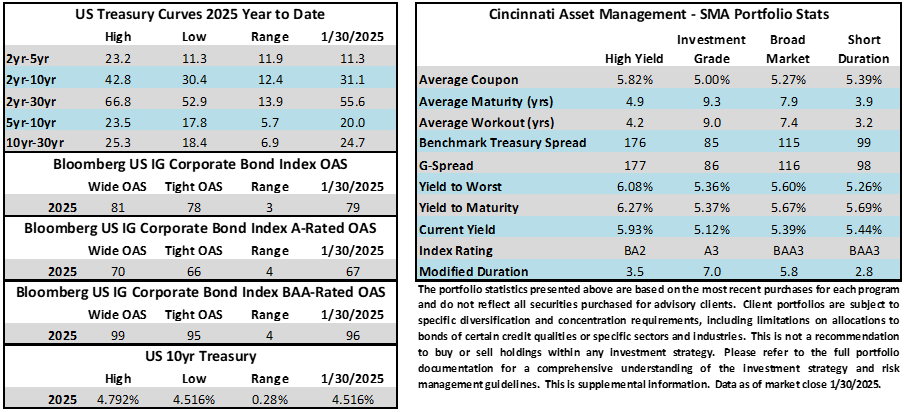

Credit spreads remained near their tightest levels of 2025 during the week. The option adjusted spread of the Bloomberg US Corporate Bond Index closed at 79 on Thursday January 30 after closing the week prior at 78. The 10yr Treasury yield moved lower on Monday morning and then traded in a tight range thereafter. The benchmark rate was 10 basis points lower on the week as we went to print Friday morning. Through Thursday, the Corporate Bond Index year-to-date total return was +0.75% while the yield to maturity for the Index closed the day at 5.29%.

Economics

It was a very busy week for economic releases that also included an FOMC meeting. On Tuesday we got a positive indicator as demand for core capital goods rose more than expected in December. However, data on that very same day showed that consumer confidence declined in the month of January. Wednesday’s Fed meeting was in-line with expectations as the central bank held rates steady and signaled that it is in no hurry to cut rates further. Recall that the Fed’s last dot plot in December showed the median expectation of just 50bps worth of rate cuts in 2025. There are now some economists on the street with out of consensus calls looking for no cuts at all or possibly even rate hikes if inflation surprises to the upside. Thursday’s GDP release showed that the U.S. economy ended 2024 on a solid note, expanding at a +2.3% annualized rate in the fourth quarter of the year. Finally on Friday, we got the Fed’s preferred inflation gauge with core PCE coming in at +2.8%, which was on the mark relative to forecasts. The consumer spending portion of the data release was strong for the second consecutive month but this was balanced out by the savings rate which dipped to a two-year low.

Next week is another busy one with ISM manufacturing/services and a host of other eco-prints. The finale will come on Friday morning with the January unemployment report.

Issuance

New corporate issuance beat estimates this week, topping $31bln. The monthly total also eclipsed the $175bln dealer forecast coming in at $186.4bln for January. This was just $3bln less than the record-breaking January 2024 tally. Syndicate desks are looking for February to be a strong month as well with forecasts predicting $175bln of new debt.

Flows

According to LSEG Lipper, for the week ended January 29, investment-grade bond funds reported a net inflow of +1.34bln. Total year-to-date flows into investment grade funds were +$5.29bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.