CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

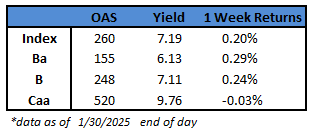

- US junk bonds rallied for five straight sessions on Thursday and are headed for best monthly gains since September, after a slew of data showed economic strength and a steady labor market. Yields have dropped 30 basis points this month, also the biggest monthly decline since September, reaching a six-week low of 7.19%.

- The gains spanned across the risk spectrum in January. CCCs, the riskiest part of the junk bond market, are set to reap positive returns for the ninth consecutive month and the longest such run since June 2021. CCC yields tumbled 40 basis points this month to 9.76%, the biggest monthly drop since November.

- The broad gains accelerated after Federal Reserve Chair Jerome Powell reiterated that the economy is strong and the labor market is resilient, reviving the supply starved primary market. January is poised to be the busiest month for supply since October.

- The primary calendar is getting crowded.

- The week has already priced $6.85b, the busiest since the week-ended September 27

- BBs are also on track to post the best monthly returns since August. Yields fell 26 basis points to 6.13%

(Bloomberg) Powell Says Fed Doesn’t Need to Be in a Hurry to Lower Rates

- Federal Reserve Chair Jerome Powell said officials are not in a rush to lower interest rates, adding the central bank is pausing to see further progress on inflation following a string of rate reductions last year.

- “We do not need to be in a hurry to adjust our policy stance,” Powell said Wednesday, noting that the economy remains strong and interest rates are no longer restraining the economy as much as they had been.

- The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.5%, after lowering rates by a full percentage point in the final months of 2024.

- Strong economic growth coupled with a solid labor market allows officials to wait for further evidence of cooling inflation before adjusting rates again. It also offers them time to evaluate how President Donald Trump’s policies on immigration, tariffs and taxes may impact the economy.

- “The committee is very much in the mode of waiting to see what policies are enacted,” Powell said. “We need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

- When asked specifically about the potential for cutting rates at the Fed’s next meeting in March, Powell reiterated policymakers are not in a rush to lower borrowing costs. He stressed that the Fed wants to see “serial readings” suggesting further progress on inflation.

- Taken together with comments from other officials in recent weeks, the remarks indicate the Fed could remain on hold for some time.

- In a post-meeting statement, officials repeated that inflation remains “somewhat elevated” but removed a reference to it having made progress toward their 2% goal — a change Powell said wasn’t meant to send a policy signal. Fed policymakers also updated their description of the labor market.

- “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid,” according to the statement.

- Officials also reiterated that the risks to their inflation and employment goals are “roughly in balance” and that the “extent and timing” of additional rate adjustments will depend on incoming data and the outlook.

- Fed officials want to keep some downward pressure on the economy to ensure inflation cools to their 2% target, but a key question for policymakers right now is just how much interest rates are currently restraining activity.

- Powell said he believes policy is meaningfully but not highly restrictive, adding rates are “meaningfully above” the so-called neutral rate, a stance of policy that neither dampens nor stimulates growth. Officials have repeatedly revised up their estimates of this rate over the past year amid stronger-than-expected economic activity and robust productivity growth.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.