CAM Investment Grade Weekly Insights

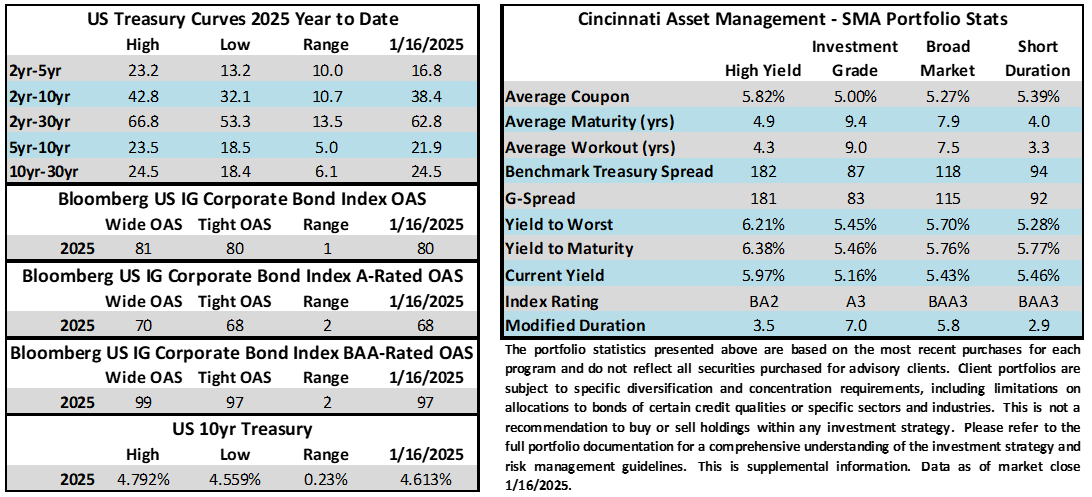

Credit spreads for most bonds were unchanged on the week as the Index has exhibited little movement in either direction thus far in 2025. The Bloomberg US Corporate Bond Index closed at 80 on Thursday January 16 after closing the week prior at the same level. The 10yr Treasury made a meaningful move lower in yield this week on the back of cooler than expected inflation data. The benchmark yield moved from 4.76% last Friday to 4.61% at the close on Thursday January 16. Through Thursday, the Index year-to-date total return was -0.06% while the yield to maturity for the Index closed the day at 5.37%.

Economics

The economic calendar was busy this week. First CPI came in as a modest surprise to the downside with core CPI coming in softer than expectations. This sparked a rally in Treasuries, driving rates lower. December retail sales were solid, boosting investor confidence in the consumer, but the number was not so good that it ignited fears about the economy overheating. Finally, the housing market showed signs of life on Friday morning with the release of December housing starts data that surprised to the upside in a big way. The housing data wasn’t all roses though as permits did decline signaling that early 2025 releases may not keep pace with December. Next week is pretty light on data with no significant economic releases. Looking further ahead, the next FOMC decision is on January 29. Interest rate futures markets were pricing in a >99% chance that the Fed will hold rates steady at that meeting at the time of our publication.

Issuance

It was a busy week for issuance this week as the banking sector started to report earnings, freeing up their chance to issue new debt. Weekly volume topped the $40bln estimate, coming in just shy of $57bln as Bank of America printed $10bln of new debt on Friday on the heels of $25bln of bank issuance on Thursday. Next week the bond market is closed on Monday in observance of Martin Luther King Jr. Day. Dealers expect $25bln of issuance next week but we would not be surprised to see a larger number amid a constructive funding environment.

Flows

According to LSEG Lipper, for the week ended January 15, investment-grade bond funds reported a net inflow of +591.8mm. Total year-to-date flows into investment grade funds were +$3.01bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.