CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are headed for the biggest weekly gain in more than two months after rallying for three straight sessions on optimism that inflation is easing and the Federal Reserve is likely to cut rates.

- The core consumer price index came in lower than anticipated this week, reviving hopes for the next rate cut to take place as early as March. Fed Governor Christopher Waller supported the sentiment further, saying the central bank could lower interest rates in the first half of 2025.

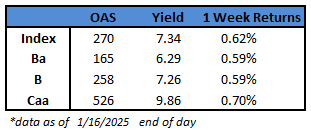

- US junk bond yields fell 18 basis points in four sessions, closing at 7.34% on Thursday

- CCCs are set for 0.7% weekly gains, the best reading in more than two months

- BB yields, the most rate-sensitive part of the junk bond market, are poised for a weekly drop

- BBs are looking to gain 0.59%, the most since early November

- The high yield bond rally this week was partly driven by light supply, with the volume at a modest $7b so far in January

- The demand for all-in yield remains solid and is expected to continue through the first half of 2025, Barlcays strategists Brad Rogoff and Dominique Toublan wrote in a note this morning

- Fundamentals remain strong across the high yield market, Barclays wrote, with the 2025 default forecast fairly benign

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.