CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

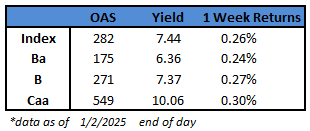

- US junk bonds rose for a third day Thursday, with the 17% return the highest in five weeks and 2024 standout CCCs continuing to lead the way.

- That riskiest segment of the high-yield market notched an eighth-straight session of gains, and the 0.2% advance Thursday was the most since Nov. 21

- Yields tumbled 10 basis points to 10.06%

- Overall, US junk is heading for a second-consecutive up week while yields have dropped six basis points to 7.44%

- The broad gains are partly due to light trading volume in light of the year-end holidays

- Market sentiment looks solid this morning ahead of manufacturing PMI data, with US equity futures rising as stocks look to end a five-day losing streak

- Meanwhile, the primary market is expected to get going next week as traders and bankers return to their desks

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.