CAM Investment Grade Weekly Insights

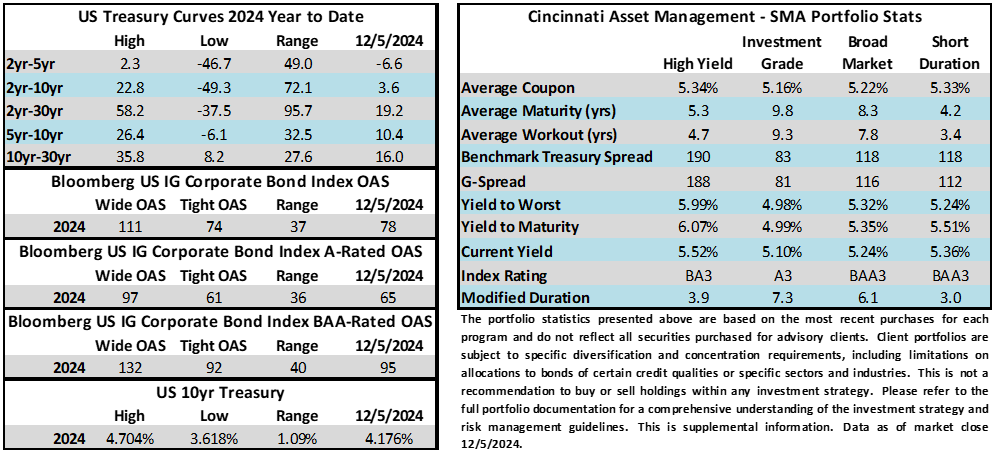

Credit spreads traded sideways this week, remaining near year-to-date tights. The Bloomberg US Corporate Bond Index closed at 78 on Thursday December 5 after closing the week prior at the same level. The 10yr Treasury is less than 1bp higher over the course of the past week, closing at 4.169% last Friday and 4.176% through Thursday. Through Thursday, the corporate bond index year-to-date total return was +4.49%. The yield to maturity for the IG corporate bond index closed at 5.02% on Thursday.

Economics

The economic calendar had numerous releases this week but there were no meaningful surprises. The big data point of the week was the employment report on Friday morning which was solid but not spectacular. Taking it altogether, the data this week kept the Fed on course to cut rates at its meeting on December 18. Interest rate futures were pricing a 91% chance of a cut as of 10:00am on Friday morning. This was up from 66% a week ago. Looking ahead to next week, the biggest economic release is CPI on Wednesday morning.

Issuance

Issuance this week was in-line with expectations as 27 companies priced $23.2bln in the primary market relative to the consensus estimate of $25bln. This type of volume is considered very health for the month of December when the calendar can tend to be more inconsistent than other months. Syndicate desks are looking for $15bln of issuance next week which will likely be biased toward Monday-Tuesday as companies look to get ahead of Wednesday’s CPI print.

Flows

According to LSEG Lipper, for the week ended December 4, investment-grade bond funds reported a net inflow of +$2.04bln. Total year-to-date flows into investment grade funds were +$78bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.