CAM Investment Grade Weekly Insights

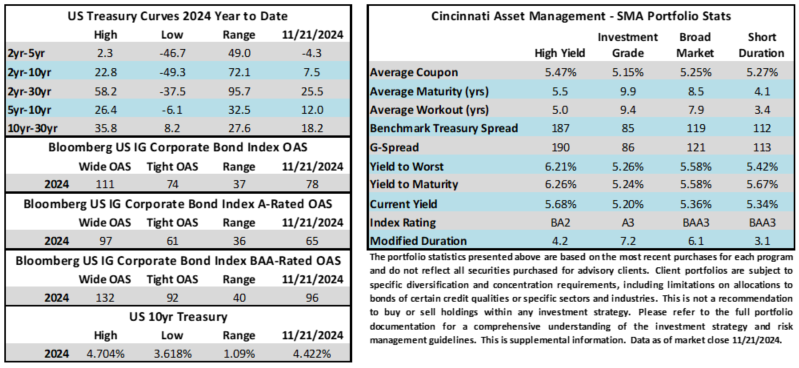

Credit spreads were largely unchanged during the week. The Bloomberg US Corporate Bond Index closed at 78 on Thursday November 21 after closing the week prior at the same level. The 10yr Treasury was also little changed during the period, closing at 4.44% last Friday and 4.42% this Thursday. Through Thursday, the corporate bond index year-to-date total return was +2.50%. The yield to maturity for the IG corporate bond index closed at 5.25% on Thursday.

Economics

It was an extremely light domestic economic calendar this past week with little of note. Next week brings much more data to parse and Wednesday in particular is action packed with releases for GDP, personal consumption, consumer spending, durable goods and Core PCE. This is the last time the Fed will get a look at its preferred inflation gauge prior to the FOMC rate decision on December 18. As of Thursday evening, interest rate futures were pricing in a 56% chance of a 25bp cut at the December meeting.

Issuance

It was a brisk week for issuance as borrowers brought nearly $37bln of new debt to market. Next week dealers are projecting $15-$20bln of issuance. If that tally comes to fruition, then we would expect the bulk of that supply to occur on Monday before activity starts to slow as the calendar progresses toward the Thanksgiving holiday.

Flows

According to LSEG Lipper, for the week ended November 20, investment-grade bond funds reported a net inflow of +$4.6bln. This was the largest weekly inflow since January of 2023. Total year-to-date flows into investment grade funds were +$75.3bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.