CAM Investment Grade Weekly Insights

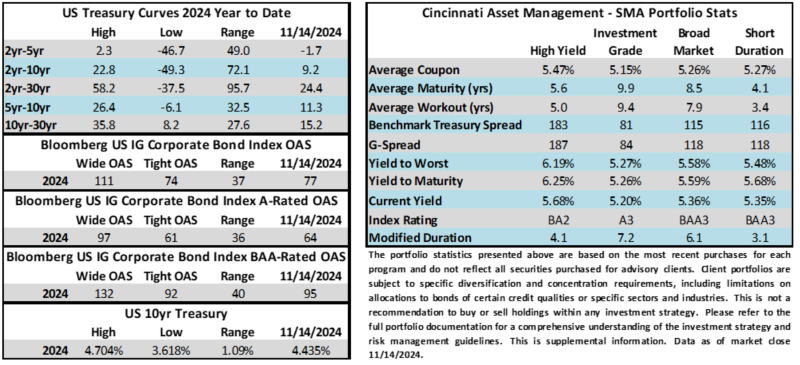

Credit spreads inched wider this week, just off their tightest levels of the year. The Bloomberg US Corporate Bond Index closed at 77 on Thursday November 14 after closing the week prior at 74. The 10yr Treasury moved from 4.30% last Friday to 4.43% through Thursday and it is a few basis points higher this Friday morning as investors continued to digest comments from Jerome Powell late Thursday afternoon that indicated that the Fed was in no hurry to raise its policy rate, casting some doubt on a cut at the December 17-18 meeting. Through Thursday, the corporate bond index year-to-date total return was +2.41%. The yield to maturity for the IG corporate bond index closed at 5.25% on Thursday.

Economics

This was the busiest week for economic releases in some time. The bond market was closed on Monday and Tuesday was quiet but things started to pick up on Wednesday with a CPI print that came in line with economist forecasts resulting in a subdued market reaction. On Thursday, PPI came in slightly higher than expected. Friday brought a very solid retail sales print for the month of October with a sharp revision upward for the September, sparking a modest sell-off in the Treasury market. As we discussed earlier in this note, Fed Chair Powell spoke in Dallas Thursday afternoon and he gave plenty of lip service to data dependency between now and the next FOMC rate decision on December 18. This has cast some doubt on the prospect of a rate cut at the next meeting and futures were pricing in a 62.4% probability of a cut at the end of trading on Thursday. This number had been as high as 82.5% just a day earlier. Next week is extremely light on the economic front domestically but there are CPI data releases in the UK and Japan. While foreign CPI is not particularly meaningful for our markets in a vacuum, they are instructive prints for the direction that those central banks may take with regard to their policy rates, which can impact the relative value of U.S. Treasuries in a global context.

Issuance

It was the busiest week for investment grade issuance in 2 months as borrowers priced almost $46bln of new debt. The total for 2024 has now eclipsed $1.4 trillion, well ahead (+28%) of 2023’s pace. Next week, syndicate desks are looking for $20-$25bln of new supply.

Flows

According to LSEG Lipper, for the week ended November 13, investment-grade bond funds reported a net outflow of -$0.444bln. This outflow broke a streak of 15 consecutive weeks of inflows. Total year-to-date flows into investment grade funds were +$70.7bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.