CAM Investment Grade Weekly Insights

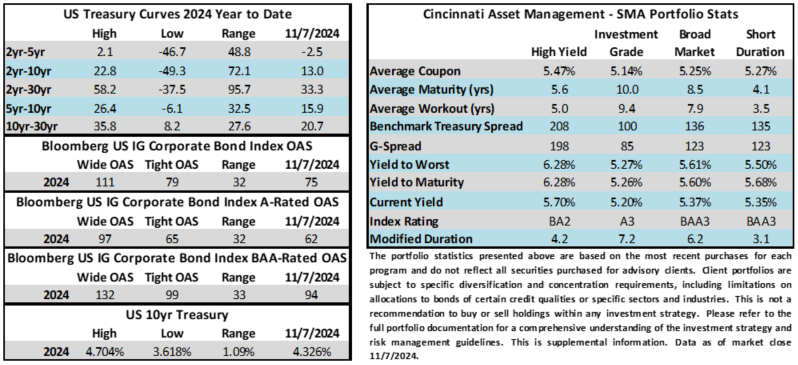

Credit spreads ripped tighter this week. The Bloomberg US Corporate Bond Index closed at 75 on Thursday November 7 after closing the week prior at 83. The index finished Thursday at its tightest level of 2024. The 10yr moved from 4.38% last Friday to 4.33% through Thursday but that does not tell the whole story as the Treasury market was quite volatile this week on the back of Tuesday’s election with most benchmark rates trading in ranges of 20+ bps throughout the week. Through Thursday, the corporate bond index year-to-date total return was +3.19%.

Economics

The election overshadowed what was a reasonably busy week for economic data but none of the prints missed expectations in either direction resulting in little market impact. The FOMC rate decision on Thursday was in line as the central bank delivered a 25bp cut to its policy rate. The Fed meets one more time this year on December 18 and interest rate futures were pricing a 71% chance of a 25bp cut at that meeting as of Thursday evening but there is plenty of data to parse over the next 5 weeks that could change investor opinions. Important potential movers next week are CPI on Wednesday, PPI on Thursday and retail sales on Friday.

Issuance

It was a very slow week for issuance, as expected. There was one $700mm deal priced on Monday and then nothing until Friday morning. With two smaller deals pending on Friday the total issuance tally for the week will likely come in at ~$1.7bln once the dust settles. Next week could see some increased activity if Treasury volatility subsides but the bond market is closed on Monday in observance of Veterans Day and there are still be many companies that are in earnings blackout. These factors could result in a lighter new issue calendar.

Flows

According to LSEG Lipper, for the week ended November 6, investment-grade bond funds reported a net inflow of +$3.3bln. This was the 15th consecutive week where the asset class reported an inflow. Total year-to-date flows into investment grade funds were +$71.1bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.