CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

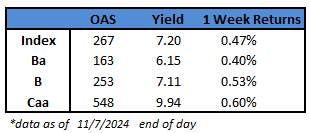

- US junk bonds are headed for their second weekly gain after rallying for five straight sessions since Donald Trump won the presidency and Republicans regained control of the Senate. Yields tumbled to a three-week low and are on track for their second weekly decline. Spreads tighten for the fourth consecutive week and hover near a three-year low of 265 basis points.

- The gains spanned all risk assets, with equities set for their best week in 2024. S&P 500 notched its 49th record this year sparking a rally across all assets and the VIX index is on track for the biggest weekly decline in three years. CCCs, the riskiest segment of the junk bond market, rose for five sessions in a row and are set to record their second weekly gain.

- The broad rally rolled on uninterrupted after the Federal Reserve cut interest-rate by 25 basis points to 4.5%-4.75% as widely expected. The expectations are that the central bank will cut by 25 basis points in the December meeting

- CCC spreads closed at 548 basis points, just 5 basis points above the 33-month low of 543. CCC yields fell below 10% again on Thursday to close at 9.94%, the lowest since April, 2022. Yields were down 10 basis points week-to-date

- BB spreads are set for their fourth weekly drop after closing at 163. BBs are poised to end their two-week losing streak with gains of 0.4% so far

- Single B spreads closed unchanged at 253 basis points, the lowest since the Great Financial Crisis, and yields fell nine basis points to 7.11% driving gains for five days in a row

- We expect tighter spreads and compression in the short term, given structurally higher yields, Brad Rogoff and Dominique Toublan wrote this morning. The election’s swift results eased markets’ worst fears and have spurred a widespread risk-on sentiment, they added

- The broad rally in risk assets is spurred by expectations that the Republican administration will be less aggressive with anti-trust laws and regulations. The market also expects lower taxes across the board

- A clear outcome in the US presidential election ended uncertainty and volatility and reopened the primary market, though cautiously

(Bloomberg) Key Takeaways From Fed Decision to Cut Rate by Quarter Point

- Federal Open Market Committee votes unanimously to lower benchmark rate by 25 basis points to target range of 4.5%-4.75%

- Fed tweaks language to note “labor market conditions have generally eased,” and repeats “the unemployment rate has moved up but remains low”

- Statement removes reference to “further” inflation progress, noting inflation “has made progress toward the committee’s 2% objective but remains somewhat elevated”

- Statement removes language saying committee has “gained greater confidence” that inflation is moving sustainably toward 2% target

- Statement maintains language saying risks to achieving employment and inflation goals “are roughly in balance”

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.