CAM Investment Grade Weekly Insights

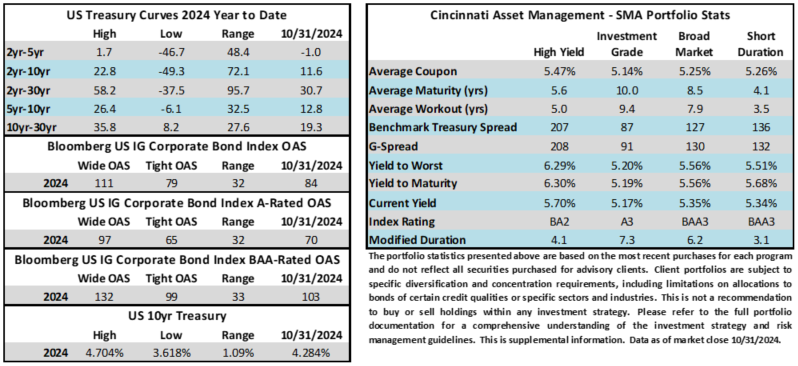

Credit spreads moved slightly wider this week but remain just 5 basis points off YTD tights. The Bloomberg US Corporate Bond Index closed at 84 on Thursday October 31 after closing the week prior at 82. The 10yr moved from 4.24% last Friday to 4.28% through Thursday. Through Thursday, the corporate bond index year-to-date total return was +2.77%. The yield to maturity on the corporate index has been boosted in recent weeks by higher Treasury yields and it closed Thursday at a YTM of 5.16%.

Economics

It was a busy week for economic data. The big takeaways were that the consumer is still spending and inflation is still sticky. The payroll report on Friday was a big miss in terms of jobs added but this report was not viewed as all that meaningful due to noise from hurricanes and labor strikes. All told, the data this week pushed Treasury yields slightly higher. As we move ahead to next week all eyes will be on the election on Tuesday which will be immediately followed by a FOMC rate decision on Wednesday afternoon. As we go to print, Fed Funds Futures are pricing in a 98.5% chance that the Fed delivers a 25bp cut.

Issuance

It was a solid week for issuance as IG-rated companies priced just over $27bln in new debt, capping the busiest October since 2021. Next week is likely to see little to no issuance, though it is possible some companies could give the market a look on Monday.

Flows

According to LSEG Lipper, for the week ended October 30, investment-grade bond funds reported a net inflow of +$3.21bln. This was the 14th consecutive week where the asset class reported an inflow. Total year-to-date flows into investment grade funds were +$67.8bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.