CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

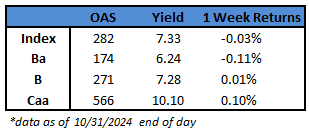

- US junk bond yields surged to a near-three-month high as the first month of the fourth quarter came to a close amid uncertainty over the path of the interest-rate policy after a string of better-than-expected economic data in October. Yields jumped 34 basis points in October, the most in six months, driving the worst monthly returns since April.

- However, CCCs, the riskiest part of the junk bond market, rallied to rack up gains for the sixth month in a row, spurred by strong economic data. Yields tumbled 26 basis points to 10.10%, just three basis points above the 30-month low. CCCs are the best performing asset class in the US fixed-income market.

- Spreads have been resilient despite volatility as higher yields fuel strong demand, Brad Rogoff and Dominique Toublan wrote this morning

- While recent macro developments have been positive, upcoming catalysts such as the labor report, US elections, and the FOMC meeting may test a credit market, they wrote

- BBs, the better-quality credit and most rate-sensitive within the high yield universe, were the worst performers in October, with a loss 0.92%. BB yields climbed to a more than three-month high of 6.24%, up 41 basis points for the month, the most since April

- Rising yields were also partly due to a surge in supply in the junk bond market

- Tight spreads and attractive yields pulled borrowers into the market in October taking the month’s supply to $24b. It was the busiest October since 2021

- Out of the more than 25 borrowers in the market, two used proceeds to fund leveraged buyouts, one funded a dividend payment and two closed strategic acquisitions

- CCCs accounted for about 19% of the total volume

- One-third of the supply came from BBs

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.