CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

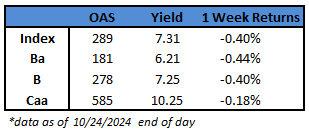

- US junk bonds are headed for their biggest weekly loss in six months as yields surge alongside rise in Treasury yields and 9% loss in equities so far this week. Yields advanced in three of the last four sessions to close at 7.31%, up 15 basis points in four sessions.

- Although the broad market recovered modestly on Thursday from the three-day losing streak, it’s on track to register losses across ratings. CCCs are set to post their first weekly loss in more than three months and the biggest since the week ended June 28.

- The losses, while partly caused by expectations that the Federal Reserve will have a more measured approach on rate cuts, are also due to a sudden surge in new bond sales. Ten borrowers sold more than $6b this week, the second busiest week this month

- Strong economic data, together with easing interest-rate policy, pulled borrowers into the market both for refinancing and funding acquisitions

- Four more borrowers sold $3.5b on Thursday and two of the four funded leveraged buyouts

- Month to date issuance is over $20b

(Bloomberg) Treasuries Plunge Like It’s 1995 as Traders See Soft Landing

- The last time US government bonds sold off this much as the Federal Reserve started cutting interest rates, Alan Greenspan was orchestrating a rare soft landing.

- Two-year yields have climbed 34 basis points since the Fed reduced rates on Sept. 18 for the first time since 2020. Yields rose similarly in 1995, when the Fed — led by Greenspan — managed to cool the economy without causing a recession. In prior rate cutting cycles going back to 1989, two-year yields on average fell 15 basis points one month after the Fed started slashing rates.

- Rising yields “reflect the reduced probability of recession risks,” said Steven Zeng, an interest rate strategist at Deutsche Bank AG. “Data has come in pretty strong. The Fed may slow the pace of rate cuts.”

- The latest backup in yields shows how a resilient US economy and buoyant financial markets limit the options for Fed Chair Jerome Powell to aggressively lower rates. Interest swaps show traders are expecting the Fed to lower rates by 128 basis points through September 2025, compared with 195 basis points priced in about a month ago.

- Global bonds have been sliding this week as investors weigh the potential of slower rate reductions.

- The selloff extended slightly on Tuesday, pushing the 10-year yield up about one basis point after an increase of 11 basis points on Monday. The recent rise has brought the yield on the benchmark to around 4.2%, up from a 15-month low of 3.6% on Sept. 17 — one day before the Fed lowered borrowing costs by half a point.

- On Tuesday, trading activities suggested that sentiment remains bearish, with a series of sales of block trades in 10-year note futures. In the options market, one trade targets the 10-year yields rising to about 4.75% by the option expiry on Nov. 22.

- In 1995, the Fed slashed interest rates just three times — from 6% to 5.25% — in six months, after lifting them sharply. Yields on 10-year notes jumped more than 100 basis points 12 months later after the first cut that year, while two-year yields rose 90 basis points.

- Currently, volatility has also picked up. The ICE BofA Move Index, which tracks expected swings in Treasuries in the coming month, has climbed to the highest level this year.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.