CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are headed for a first weekly gain in three, propelled by CCCs, the riskiest part of the high-yield market, after strong economic data underlined the resilience of the economy.

- A string of recent reports showed robust retail sales, expanding services activity and a strong jobs market, easing concerns of a recession that would lead to a strong of corporate defaults.

- CCCs are poised to record gains for the 16th consecutive week, the longest streak since March 2017. They rallied for five straight sessions this week, bucking the broader trend

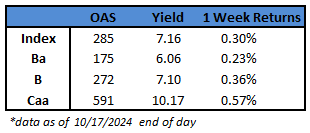

- CCC spreads dropped to 591 basis points, the lowest since February 2022. They tightened 21 basis points week-to-date and are on track for a seventh weekly decline

- CCC yields plunged to 10.17%, the lowest since April 2022. They are down 18 basis points so far this week

- BBs are also set to close the week with modest gains, the first in three weeks, though they posted small losses on Thursday after three-day rally

- Single Bs are also headed for a first gain in three weeks

- Credit markets traded well this week amid favorable supply-demand technicals and supportive macro data, Brad Rogoff and Dominique Toublan of Barclays wrote in a note Friday

- The broad and steady rally amid a resilient economy and easing interest-rate policy spurred strong risk appetite, driving capital-market activity and moving October volume to almost $14b

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.