CAM Investment Grade Weekly Insights

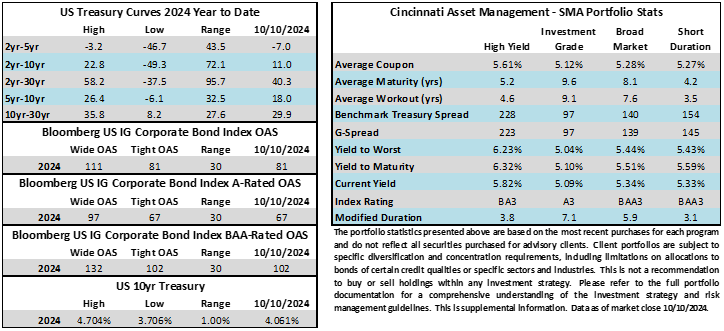

Credit spreads inched tighter this week, breaching a new year-to-date low. The Bloomberg US Corporate Bond Index closed at 81 on Thursday October 10 after closing the week prior at 83. The 10yr Treasury yield was 9 basis points higher this week through Thursday, moving from 3.97% to 4.06%. Through Thursday, the corporate bond index year-to-date total return was +3.97%.

Economics

The highlights this week were led by CPI and PPI on Thursday and Friday, respectively. CPI came in a smidge hotter than expectations but it was not enough to meaningfully alter the outlook with regard to inflation and there was no real discernable impact to equities, credit or rates. The PPI data set was relatively tame and best described as in-line with expectations.

Next week is a light one from a data perspective with the only meaningful print occurring next Thursday morning with retail sales.

Issuance

It was a solid week for issuance as companies priced $16.1bln of new debt, besting the top end of the estimated range ($15bln). Bank earnings season is underway as of Friday and the big-six money center banks are expected to dabble in the primary market next week creating a wide range of estimates with dealers looking for $10-$30bln of new supply. Next week is a holiday shortened one with the market closed on Monday for Columbus Day. As the calendar rolls into the second half of October it would not surprise us if the new issue market took a breather heading into election season.

Flows

According to LSEG Lipper, for the week ended October 9, investment-grade bond funds reported a net inflow of +$1.83bln. This was the 11th consecutive week where the asset class reported an inflow. Total year-to-date flows into investment grade funds were +$60.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.