CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

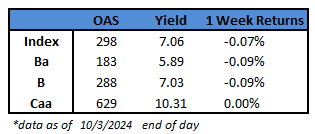

- US junk bonds kick off the fourth quarter on a somber note and are on track to end the eight-week gaining streak to post their biggest weekly loss in four months. The US junk bond rally faded as the market posted losses for the second consecutive session on Thursday.

- The broad rally petered out amid growing tensions in the Middle East and because data showed US services activity expanded at the fastest pace since February 2023. That damped hopes for a big rate cut in November.

- The losses this week spanned across ratings in the US high-yield market. BBs are also headed for their first weekly loss in nine and the biggest since early May

- US junk bond yields climbed to a two-week high of 7.06% after steadily rising for four straight sessions this week. This will be the first increase in nine weeks

- BB yields also rose seven basis points in four sessions to 5.89%, a more than two week high

- CCCs also recorded losses for two sessions in a row and are poised to close the week unchanged. Yields, though, have dropped further to a new 29-month low of 10.31%. Spreads closed at a new 30-month low of 629 basis points

- While the broad rally took a pause, still-attractive yields and tight spreads against the backdrop of resilient economy and easing monetary policy pulled borrowers into the US junk bond market

- After a brief respite from the supply deluge in September, five borrowers sold near $5b in the primary market this week

- Appetite for credit remained strong despite tight valuations, lower yields and elevated supply, Barclays strategists Brad Rogoff and Dominique Toublan wrote on Friday

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.