CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

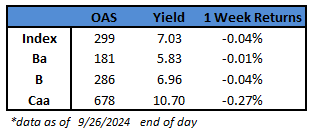

- US junk bonds rebounded cautiously after a four-day losing streak as spreads dropped just below 300 basis points and yields held steady at 7.03%.

- Junk bond yields, prices and returns came under pressure after a barrage of new issuance took the week’s volume to $9b and September supply to more than $34b. The month’s supply is up 44% year-over-year

- 17 borrowers, the most since May, jumped into the market to sell $9b this week

- The primary market was spurred by a half percentage-point cut in interest rates by the Federal Reserve.

- Investors, still hungry for new paper, continued to flock to new issues

- Barclays strategists Bradley Rogoff and Dominique Toublan expect to see attractive opportunities across the investment grade and high yield market despite tighter valuations after the beginning of the rate- cutting cycle in the US and Europe

- The market rebounded on Thursday across the rating spectrum, ending the four-day decline

- Barclays strategists Rogoff, Andrew Johnson and Corry Short expect CCCs to outperform through the year-end. Historically, when CCCs outperform through the third quarter, they tend to continue that trend through the year-end, they wrote on Friday

(Bloomberg) Fed’s Favored Inflation Gauge, Consumer Spending Barely Rise

- The Federal Reserve’s preferred measure of underlying US inflation and household spending rose modestly in August, underscoring a cooling economy.

- The so-called core personal consumption expenditures price index, which excludes volatile food and energy items, increased 0.1% from July, according to Bureau of Economic Analysis data out Friday. On a three-month annualized basis, the measure rose 2.1%, in line with the central bank’s target.

- Spending also rose 0.1% after adjusting for inflation. Nominal personal income increased 0.2% and the saving rate eased to 4.8%.

- Treasury yields and the dollar fell on expectations the figures will keep the Fed on track for more rate cuts in the coming months while fueling ongoing debate over how big the reductions should be. The central bank opted for an outsize half-point cut this month to kick off its easing cycle, and investors are split over whether it will take a similar step or opt for a smaller move in November, according to futures.

- “The modest rise in consumer inflation in August on its own provides strong reason for the Fed to continue easing the still restrictive monetary policy stance,” Kathy Bostjancic, chief economist at Nationwide, said in a note. “The tepid 0.1% rise in real consumer spending in August underscores that consumers are becoming more frugal in their spending and that the momentum in spending is slowing.”

- Details of the August inflation numbers showed a broad cooling. Services prices excluding housing and energy rose 0.2% for a second month. Goods prices minus food and energy declined 0.2%, the most in three months.

- The spending data also points to an economy that’s gradually slowing this year. Overall services spending, which makes up the bulk of household consumption, rose 0.2% in August, marking the smallest three-month gain since October 2023. Goods spending was unchanged following a solid advance in July.

- Wages and salaries rose by the most since May. Still, growth in overall disposable income slowed, restrained by declines in proprietors’ income, interest income and dividend income.

- Separate data published Friday by the Census Bureau showed the advance goods trade deficit narrowed in August to $94.3 billion — the least since March — while growth in wholesale and retail inventories moderated. Results of a Bloomberg survey showed forecasters expect inflation to return to the Fed’s 2% target by early next year.

- Friday’s data follow annual revisions to gross domestic product data published Thursday by the BEA, which showed faster economic growth and more saving — fueled by higher incomes — than previously reported in 2022 and 2023.

- The Bureau of Labor Statistics will provide a monthly update on hiring and unemployment for September on Oct. 4.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.