CAM Investment Grade Weekly Insights

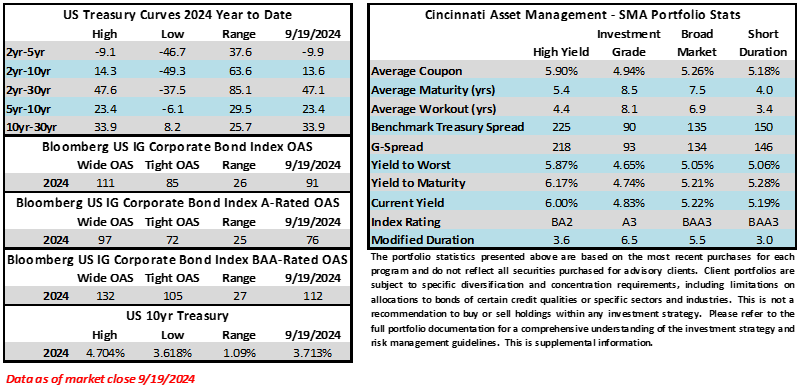

Credit spreads moved meaningfully tighter this week with the index trading at its richest level since late July. The Bloomberg US Corporate Bond Index closed at 91 on Thursday September 19 after closing the week prior at 96. The 10yr Treasury yield drifted higher throughout the week, up 6 basis points from where it closed last Friday. The entire Treasury curve continued to steepen on the back of Wednesday’s policy rate cut by the FOMC. Through Thursday, the corporate bond index year-to-date total return was +5.58%.

Economics

The long awaited FOMC rate cut finally came to fruition this week. The Fed elected to kick things off with a 50bp cut. We would not call this a surprise, per se, but 25bps was what the market was looking for up until the middle of last week when the odds (Fed Funds futures) started to show an increasing likelihood of 50bps. The Summary of Economic Projections (SEP or Dot Plot) that was released at this meeting showed that a majority of FOMC members believe that there will be 50bps of additional cuts in 2024 and 100bps of cuts in 2025. The Fed does not meet in October so market prognosticators have extrapolated a 25bp cut at each of the November and December meetings. By all accounts it appears that the Fed was close to delivering a 25bp cut at its July meeting (there was no August meeting) and employment revisions and economic data since that time led them to “catch up” to the fact that they did not cut earlier by kicking things off with 50bps instead of 25bps. Remember that the September SEP is merely a forecast and does not necessarily reflect what will actually occur in the future. The SEP is only updated once every three months and simply reflects the median view of the FOMC members at a given point in time. That being said, 50bps of cuts in ’24 with an additional 100bps in ’25 sounds right to us given what we know today and what has been a resilient economy. We would also expect that at some point in 2025 the Fed may elect to end its balance sheet reduction (aka QT or quantitative tightening). The Fed kept its current plan in place for the time being where it will continue to allow $60bln of its balance sheet reduce each month. The current cycle of QT has reduced the Fed’s balance sheet from a peak of $9bln in mid-2022 to just above $7bln today, which is still elevated relative to pre-pandemic levels. The Fed’s balance sheet prior to March 2020 was just ~$4.25bln and prior to the 2008 financial crisis it was zero!

Next week is reasonably busy from an economic data standpoint. The highlights include consumer confidence, new home sales, GDP and the main event next Friday morning with core PCE.

Issuance

Issuance was light this week and underwhelmed relative to expectations as just $12.4bln of new debt was sold relative to the forecast of $25bln. In our view this “miss” can be explained by the mid-week Fed meeting and pull forward of issuance earlier this month as borrowers took advantage of a red-hot primary market in the days immediately following Labor Day. Dealers are calling for $20-$25bln of issuance next week. Over $131bln of debt has been priced so far in the month of September 2024. The five-year average for September is $136bln with the busiest year being 2020 when $164bln priced during the month.

Flows

According to LSEG Lipper, for the week ended September 18, investment-grade bond funds reported a net inflow of +$1.86bln. Short and intermediate investment-grade bond funds have seen positive flows 32 of the past 38 weeks. The total year-to-date flows into investment grade funds are +$53.8bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.