CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

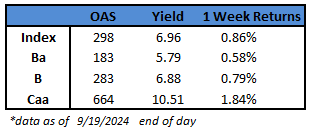

- US junk bonds are headed for their seventh weekly gain after amassing the biggest one-day returns in six weeks. The market is poised for the biggest weekly jump in four months, with returns of 0.86% so far this week.

- Yields plunged, falling below 7% for the first time since April 2022, after Fed Chair Jerome Powell made an aggressive start to easing by lowering the interest rate by a half percentage point aimed at bolstering the US labor market.

- The broad gains spanned across the US high yield market on expectations that the Federal Reserve will be able to engineer a soft landing. After the 50 basis point cut this week, Bank of America economists expect another 75 basis points cuts in the fourth quarter.

- Also, Chair Powell instilled confidence in markets claiming that the aggressive 50 basis point cut was just “recalibration” and was not a sign of fundamental deterioration, Brad Rogoff and Dominique Toublan wrote on Friday.

- CCCs, the riskiest tier of the US junk bond market, is on track for a 12th week of gains, the longest rallying streak since January 2021. The week-to-date returns are 1.84%, the most in a week in 2024, after notching up gains for 12 days in a row.

- CCC yields tumbled 16 basis points on Friday to 10.51%, the lowest since May 2022, and is on course for a third week of declines after dropping 43 basis points this week.

- CCC spreads tightened for the ninth consecutive session to 664, the longest tightening stretch in 20 months.

- BB yields dropped to a new 27-month low and closed at 5.79%. Spreads closed at 183.

- Primary activity gained new momentum as the soft landing narrative gained market credence against the backdrop of falling inflation and easing interest-rates.

- The market has seen a flurry of new deals, bringing the September tally to $24b, up 34% already over last September and there one full week to go.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.