CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds gained for the second straight session after data showed US companies added the fewest jobs since the start of 2021, reinforcing the broad trend that the labor market is cooling substantially. Yields tumbled seven basis points to a more than two-year low.

- While the labor market is clearly slowing down, the US services sector expanded at a moderate pace, giving credence to the market consensus that the economy is still not headed toward a recession. The gains in the US high-yield market spanned across ratings, driving a crowded primary market.

- Five US borrowers combined to sell a little more than $4b on Thursday, the busiest session in four weeks. US companies took advantage of the current window of opportunity ahead of Friday’s jobs data and the Federal Reserve decision later this month as 11 borrowers priced more than $7.5b in just three sessions so far this week

- Most bonds sold this week were rated BB or in high single Bs. Four of the five priced at the tight end of talk.

- The junk-market rebound began Wednesday after US job openings hit the lowest level since January 2021, boosting market participants’ bets on rate cuts

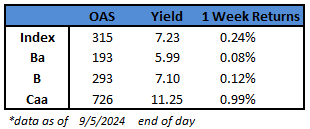

- CCCs, the riskiest segment of the US corporate debt market, racked up the biggest gains in four weeks for the second day in a row and yields plummeted 25 basis points to a low of 11.25%, the lowest since May 6, 2022

- BB yields dropped below 6% again to close at 5.99%, still near the two-year low of 5.97%

- The slowing demand for workers, as reflected in US job-openings data and private payrolls, combined with shrinking US manufacturing activity, spurred bets on faster and bigger rate cuts

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.