CAM Investment Grade Weekly Insights

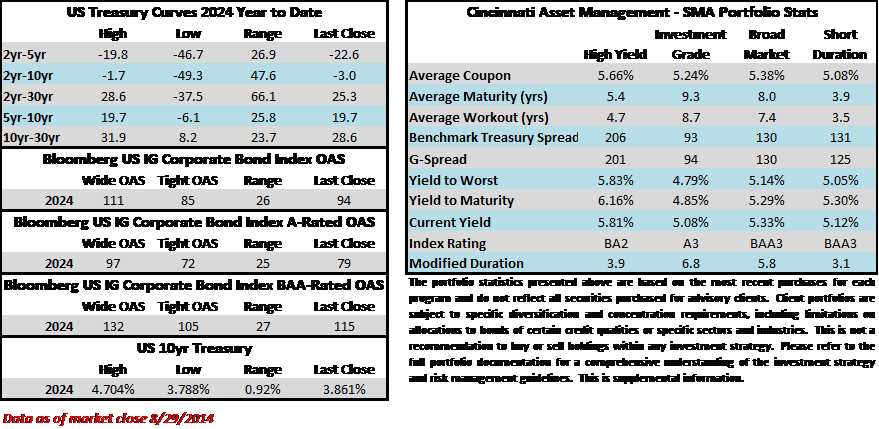

Credit spreads exhibited little change during the week before Labor Day. The Bloomberg US Corporate Bond Index closed at 94 on Thursday August 29 after closing the week prior at the same level. The 10yr Treasury yield was slightly higher throughout this week, up 6 basis points from last week through Thursday’s close. Through Thursday, the corporate bond index year to date total return was +3.77%.

Economics

There were several big data releases this week but all were within the realm of expectations. Durable goods orders surprised to the upside on Monday but it was driven almost entirely by aircraft which can be volatile. GDP too came in slightly higher than expectations amid resilient consumer spending. Finally, on Friday morning we got the Fed’s preferred inflation gauge. It was a relatively good print for PCE that along with revisions showed that moderating inflation is trending in the right direction, inching closer to the Fed’s 2% target. Next week has some reasonably meaningful economic releases including the employment report on Friday which is the last big data point ahead of the next FOMC meeting on September 18.

Issuance

Companies priced just $2.05bln of new debt this week across a handful of small deals. Syndicate desks are predicting $125bln of new issue volume for the month of September. In 2023, borrowers priced $55bln during the first week of September and 2024’s haul could be similar, with a flurry of activity expected right out of the gate. The year-to-date issuance total now stands at $1.094 trillion.

Flows

According to LSEG Lipper, for the week ended August 28, investment-grade bond funds reported a net inflow of +$1.76bln. Short and intermediate investment-grade bond funds have seen positive flows 29 of the past 35 weeks. The total year-to-date flows into investment grade funds are +$46.81bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.