CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

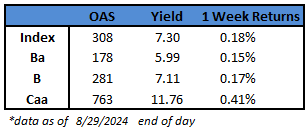

- The High Yield Index didn’t have much going on over the past week

- There were no new issues to speak of during the late summer lull. Month-to-date issuance remains at $18 billion, and Year-to-date issuance stands at $197 billion.

- The Index spread tightened 4 basis points to 308 and the yield moved just 1 basis point lower to settle at 7.30.

(Bloomberg) Powell Says ‘Time Has Come’ for Fed to Cut Interest Rates

- Chair Jerome Powell said the time has come for the Federal Reserve to cut its key policy rate, affirming expectations that officials will begin lowering borrowing costs next month and making clear his intention to prevent further cooling in the labor market.

- “The time has come for policy to adjust,” Powell said last Friday (8/23/24) in the text of a speech at the Kansas City’s Fed’s annual conference in Jackson Hole, Wyoming. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

- The Fed chief acknowledged recent progress on inflation, which has resumed moderating in recent months after stalling earlier in the year: “My confidence has grown that inflation is on a sustainable path back to 2%,” he said, referring to the central bank’s inflation target.

- The Fed has held its benchmark rate in a range of 5.25%-5.5% — its highest level in more than two decades — for the last year in support of that goal, propping up borrowing costs across the economy.

- Yet just as inflation has neared its target, cracks have appeared on the employment front, prompting several Fed officials to worry that high rates now pose a threat to the economy’s continued strength. Warning signals included a disappointing July jobs report that rattled financial markets.

- “We do not seek or welcome further cooling in labor market conditions.” Powell said, adding that the slowdown in the labor market was “unmistakable.”

- After being late to raise rates in response to an inflation surge during the Covid-19 pandemic, Powell’s remarks underscore how Fed officials are hoping to avoid another policy error.

- “Our objective has been to restore price stability while maintaining a strong labor market, avoiding the sharp increases in unemployment that characterized earlier disinflationary episodes when inflation expectations were less well anchored,” Powell said. “While the task is not complete, we have made a good deal of progress toward that outcome.”

- At their last gathering in July, the “vast majority” of Fed officials felt it would likely be appropriate to cut rates in September if economic data continued to come in as expected.

- While inflation remains above the Fed’s goal, it has retreated markedly from its recent peak of 7.1% in 2022. The central bank’s preferred inflation gauge, the personal consumption expenditures price index, rose 2.5% in June from a year earlier. A separate measure of underlying consumer inflation cooled in July for a fourth straight month. Meanwhile, the unemployment rate ticked up last month, also for a fourth straight time, reaching 4.3%, and employers pulled back on the pace of hiring.

- Powell said policymakers “will do everything we can to support a strong labor market as we make further progress toward price stability.”

- At their gathering next month, Fed officials will release fresh set of economic projections and indicate where they anticipate their policy rate will be at the end of each year through 2026.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.