CAM Investment Grade Weekly Insights

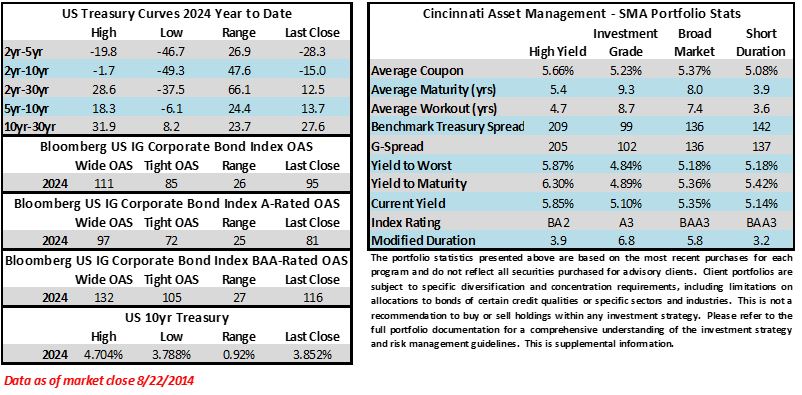

Credit spreads drifted sideways this week and are looking to finish the period just slightly tighter. The Bloomberg US Corporate Bond Index closed at 95 on Thursday August 22 after closing the week prior at 96. The 10yr Treasury yield was little changed from the week prior, less than 3 basis points lower week over week through Thursday. Through Thursday, the corporate bond index year to date total return was +3.63%.

Economics

It was a light week for economic releases. There was a BLS payrolls revision on Wednesday that showed that job growth over most of the past year was lighter than expected but this was not a market moving event. FOMC meeting minutes, jobless claims that were mostly inline and a S&P PMI print that beat expectations rounded things out but none were particularly meaningful for market direction. As we go to print this Friday morning, Jerome Powell is just beginning to deliver his policy speech at the Jackson Hole Economic Symposium and his prepared remarks indicate that the Fed is nearly ready to begin cutting its policy rate. Next week things ramp up with durable goods on Monday, GDP on Wednesday and income/spending data along with PCE data on Friday.

Issuance

It was a strong week for issuance considering that the second half of August is typically seasonally slow. Investment grade companies priced nearly $23bln of new debt with Kroger leading the way as it priced a $10.5bln seven-part jumbo deal to prefund a portion of the cash component for its potential acquisition of Albertsons. Next week syndicate desks are looking for less than $5bln of new debt and $0 is a real possibility as the week before Labor Day is nearly always one of the quietest of the year for the primary market. The year-to-date issuance total now stands at $1.091trln, +27% ahead of 2023’s pace.

Flows

According to LSEG Lipper, for the week ended August 21, investment-grade bond funds reported a net outflow of -$0.345bln. Short and intermediate investment-grade bond funds have seen positive flows 28 of the past 34 weeks. YTD flows into IG stand at +$45.05bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.