CAM Investment Grade Weekly Insights

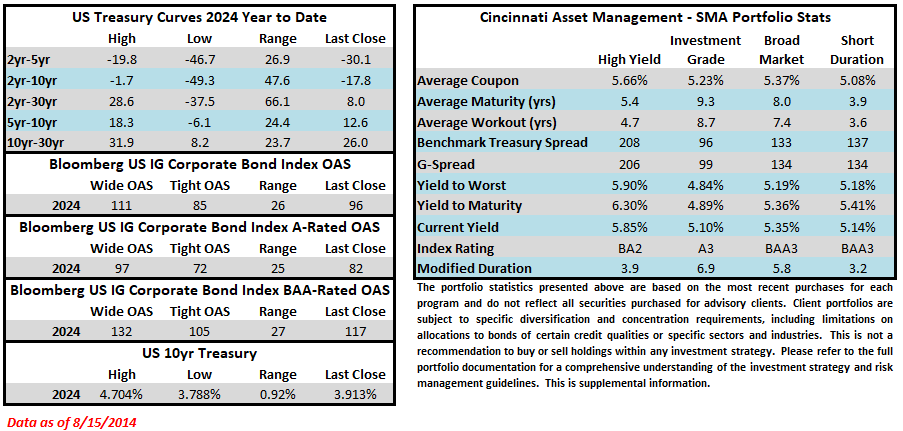

Credit spreads initially moved wider this week on Monday before snapping tighter throughout the rest of the period. The Bloomberg US Corporate Bond Index closed at 96 on Thursday August 15 after closing the week prior at 102. The 10yr Treasury yield experienced some meaningful intraday moves throughout the week but was little changed from the week prior, only 3 basis points lower through Thursday. Through Thursday, the corporate bond index year to date total return was +3.11%.

Economics

There was plenty of action this week with a bevy of economic releases. PPI on Tuesday and CPI on Wednesday both came in slightly below estimates, indicating that slowing inflation has maintained its momentum. On Thursday morning, retail sales data for July came in much better than expected, although the control group posted just a modest gain that showed deceleration in control group spending from June to July. Still, there was little in the retail sales print that indicated that the economy was anywhere near a consumer-led recession during the month of July leaving open the possibility of a soft landing. Friday also saw a positive print for consumer sentiment data which saw an increase in sentiment for the first time in five months. Next week’s economic docket is extremely light but there is plenty of action to come in the weeks that follow. Looking ahead, we await Jerome Powell’s policy speech at The Jackson Hole Economic Symposium on August 23rd, followed by core PCE release on August 30th. On September 6th we will get the August employment report followed by a CPI print on the 11th which could set the table for the beginning of an easing cycle with an FOMC decision on September 18th.

Issuance

It was a solid week for corporate credit issuance as borrowing companies sold $29bln in new debt. Monday in particular was a busy day as 16 companies priced more than $18bln of new bonds across dozens of maturity bands. The last two weeks of August are typically seasonally slow but syndicate desks are looking for $20bln in new debt next week. The backdrop for borrowers remains favorable amid strong investor demand for high quality risk assets at yields that remain elevated relative to the recent past. The year-to-date issuance tally continues to push well ahead (+26%) of 2023’s pace and 2024 volume has now topped $1,068bln.

Flows

According to LSEG Lipper, for the week ended August 14, investment-grade bond funds reported a net inflow of +$1.14bln. Short and intermediate investment-grade bond funds have seen positive flows 28 of the past 33 weeks. YTD flows into IG stand at +$45.4bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.