CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

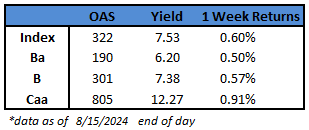

- US junk bonds are headed for their second straight weekly gain — and the biggest in five weeks — as yields plunged to a fresh year-to-date low of 7.53% after US inflation eased for the fourth month on a year-over-year basis. Soft economic data reinforced market bets that the Federal Reserve will begin cutting rates in September.

- The broad rally in the US junk-bond market extended across ratings. BB yields hit a new two-year low of 6.20% and spreads dropped below 200 basis points, driving the second straight week of gains and the most since the week ended July 12. BBs have rallied for eight consecutive sessions.

- After oscillating between concerns about inflation and growth over the past 12 months, growth worries seem to be driving markets now, fueling expectations of a 50bps cut in each of the next five Fed meetings, Goldman Sachs economists Kamakshya Trivedi and Dominic Wilson wrote on Thursday

- However, Trivedi and Wilson write, growth fears have moved too far, and some sections of the market look overpriced. They expect continued expansion and decelerating inflation, rather than an imminent recession

- While acknowledging risks from data and geopolitics, there is still value in positioning for the “right tail” to be able to respond quickly to policy easing when it occurs, they wrote

- Bloomberg’s US chief economist Anna Wong expects Fed Chair Powell to say at this year’s Jackson Hole gathering that monetary policy has worked as intended and the current level of rates is restrictive while also signaling that a rate cut is coming

- The recent rally after the Aug. 5 rout saw yields sink to a 2024 low, pulling borrowers into the market

- 11 borrowers sold $8.6b this week, taking month-to-date tally to $17b already

(Bloomberg) Core US Inflation Eases a Fourth Month, Sealing Fed Rate Cut

- Underlying US inflation eased for a fourth month on an annual basis in July, keeping the Federal Reserve on track to lower interest rates next month.

- The so-called core consumer price index — which excludes food and energy costs — increased 3.2% in July from a year ago, still the slowest pace since early 2021.

- Economists see the core gauge as a better indicator of underlying inflation than the overall CPI. That measure also climbed 2.9% from a year ago. BLS said nearly 90% of the monthly advance was due to shelter, which accelerated from June.

- Inflation is still broadly on a downward trend as the economy slowly shifts into a lower gear. Combined with a softening job market, the Fed is widely expected to start lowering interest rates next month, while the size of the cut will likely be determined by more incoming data.

- “Investors and policymakers alike will find this report mostly good for markets and the economy,” said Jeffrey Roach,chief economist at LPL Financial. “As inflation decelerates, the Fed can legitimately cut rates yet keep policy restrictive overall.”

- Before their September meeting, officials will get more inflation readings plus another jobs report — which will be heavily scrutinized after the disappointing July figures helped spark a global market selloff and fanned recession fears.

- Fed Chair Jerome Powell and his colleagues have recently said they’re focusing more on the labor side of their dual mandate, which they’re likely to stress at their annual symposium in Jackson Hole, Wyoming next week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.