CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

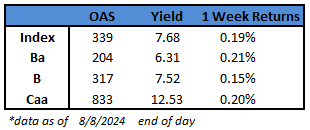

- US junk bonds staged a solid comeback from last week’s losses and are on track to post modest gains as yields plunged 22 basis points in three sessions – from 7.90% to 7.68% – and spreads tightened 42bps to 339.

- The rally extended across the ratings spectrum after labor market data eased worries about an imminent recession. The riskiest tier of the junk bond market, CCCs, are headed toward their sixth straight week of gains, the longest rising streak in 2024.

- CCC yields fell 39 basis in three sessions this week – from 12.92% on Monday to 12.53% at close on Thursday. Spreads dropped 57 basis points in the same period – from 890 to 833

- After several months of calm, spreads have been sharply wider over the past week, albeit well off the worst levels, amid slowdown concerns and positioning unwinds. “We see few signs of true credit stress,” but a further decline in yields could pressure spreads further, Brad Rogoff and Dominique Toublan of Barclays wrote Friday

- A strong rebound, with yields dropping and spreads tightening pulled US borrowers into the market on Thursday

- Six borrowers sold more than $4 billion, driving the month-to-date tally to $7.3b

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.