CAM Investment Grade Weekly Insights

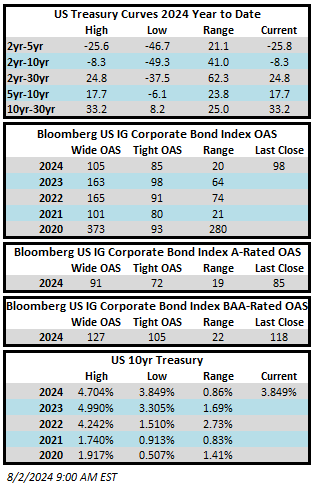

Credit spreads were meaningfully wider on the week while Treasuries rallied, sending yields lower. The Bloomberg US Corporate Bond Index closed at 98 on Thursday August 1 after closing the week prior at 93. The 10yr Treasury yield traded through its previous YTD low of 3.88% from back in January and it is trading at 3.85% this Friday morning. This is after the 10yr benchmark closed last week at 4.19%. Through Thursday, the corporate bond index YTD total return was +2.16% while the yield-to-maturity for the benchmark was 5.10%.

Economics

It was a big week for data with all eyes on the Fed Wednesday afternoon. The FOMC elected not to move its policy rate, as expected, and chairman Powell hinted at the fact that near term cuts could be on the horizon as soon as the September meeting. What really threw markets into a tizzy was the NFP release on Friday morning which was a big miss to the downside. As of the time we are going to print this morning the numbers are quite volatile. Treasury curves are at their steepest levels of the 2024 and equity futures have fallen off a cliff. The market narrative has quickly shifted from questioning if and when we would get a cut at all in 2024 to pondering 3 or 4 cuts. Some market participants are now even calling for a 50bp cut at the September meeting for fear that the economy is slowing too rapidly. We would point out that this is only one job report, and by the way, the economy is still adding jobs not shedding them. While the Sahm rule has been triggered, the unemployment rate still remains low by historical standards. We have always been in the camp that expects a modest recession at some point and this jobs print could be the first step to that end but it is merely one data point. One thing is certain, the market will have plenty of time to speculate between now and the FOMC’s next meeting on September 18th. It could be a long month and a half!

Issuance

It was once again another solid week for summer issuance as companies sold $31bln in new bonds. It ended up as the highest volume July for issuance since 2017 and the second busiest ever. Syndicate desks are looking for $40bln of new supply next week but that is contingent on a pull back in some of the volatility that the rates markets are experiencing this morning. Even with spreads off their tights, CFOs and treasurers that were planning to borrow are likely excited at the prospect of lower Treasury yields which mean lower interest expense on new debt. The year-to-date issuance tally has now climbed to $995bln. For context, the $1 trillion mark was not reached until October during 2023 and 2022 according to Bloomberg.

Flows

According to LSEG Lipper, for the week ended July 31, investment-grade bond funds reported a net inflow of +$1.79bln. Short and intermediate investment-grade bond funds have seen positive flows 26 of the past 31 weeks. YTD flows into IG stand at +$42.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.