CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

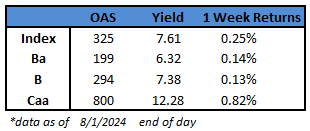

- US junk bond spreads jumped 11 basis points, the most one-day widening in six months, to a three-month high of 325, abruptly snapping the broad rally and triggering negative returns across the risk spectrum. The losses came after data showed further evidence that US manufacturing shrank the most in eight months and unemployment claims rose to a one-year high.

- The broad market losses driven by weak data seemed to question the Federal Reserve’s decision to not cut rates in the meeting earlier this week.

- The market has now priced in three rate cuts in 2024. The swaps market shows there is a 50% chance of one 50bps cut

- Softer-than-expected economic data from the past few weeks point to an economy that’s potentially slowing too fast. The market is clearly worried about tail risk, and a flight to quality is taking place, Brad Rogoff and Dominique Toublan of Barclays wrote on Friday

- The losses in the US junk bond cut across ratings taking cue from tumbling equities and a sell off in US Treasuries

- US junk bond yields rose , though modestly, to 7.61%, still just two basis points above the 2024 low of 7.59%

- BB spreads widened 10 basis points, also the biggest one-day jump in six months, to a two-month high 199. Yields rose to 6.32%, still just four basis points above a 17-month low of 7.28%

- CCC spreads rose 12 basis points, the most widening in more than two weeks, to 800. Yields rose to 12.28%

- The wild swings across risk assets are spurred by investors’ struggle to assess broad macro data and weakening corporate outlook at a time when the Fed seems to be not terribly concerned about growth

(Bloomberg) Powell Says Fed Could Cut Rates ‘As Soon As’ September Meeting

- Federal Reserve Chair Jerome Powell said an interest-rate cut could come as soon as September after the US central bank voted to leave its benchmark at the highest level in more than two decades.

- “The question will be whether the totality of the data, the evolving outlook, and the balance of risks are consistent with rising confidence on inflation and maintaining a solid labor market,” Powell told reporters Wednesday. “If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September.”

- His comments followed a Federal Open Market Committee decision to leave the federal funds rate in a range of 5.25% to 5.5%, a level they have maintained since last July.

- Policymakers also made several adjustments to the language of a statement released after their two-day meeting in Washington, signaling they are closer to reducing borrowing costs. Notably, the committee shifted to saying it is “attentive to the risks to both sides of its dual mandate,” rather than prior wording focused just on inflation risks.

- “In recent months, there has been some further progress toward the committee’s 2% inflation objective,” the FOMC statement said. “The committee judges that the risks to achieving its employment and inflation goals continue to move into better balance.”

- Officials also tempered their assessment of the labor market, noting job gains had moderated and the unemployment rate has moved up, but is still low. They said inflation has eased over the past year but remains “somewhat elevated.”

- Still, policymakers retained language that they didn’t expect it would be appropriate to lower borrowing costs until they had gained “greater confidence” that inflation is moving toward their target sustainably.

- The changes in the statement solidify a shift in tone among several policymakers, including Powell, recognizing growing risks to the labor market.

- A number of former Fed officials and economists had urged the Fed to cut rates at this meeting, including former Fed Vice Chair Alan Blinder and former New York Fed President William Dudley.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.