CAM Investment Grade Weekly Insights

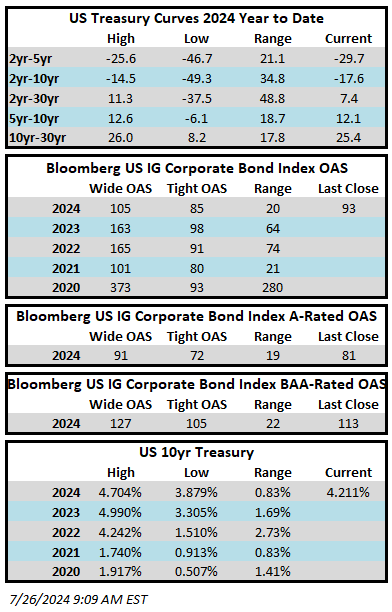

Credit spreads were modestly wider on the week. The Bloomberg US Corporate Bond Index closed at 93 on Thursday July 25 after closing the week prior at 91. The 10yr Treasury yield was slightly lower on the week at press time, trading at 4.21% this Friday morning after closing last week at 4.24%. Through Thursday, the corporate bond index YTD total return was +0.61% while the yield-to-maturity for the benchmark was 5.32%.

Economics

It was quite a busy week for economic releases but most of what we got was in line with expectations with the exception of GDP which came in meaningfully better than consensus. The biggest print of the week was the Fed’s preferred inflation gauge on Friday which showed that inflation rose at a timid pace in June while consumer spending held up well but not too well. Traders viewed this as a print that keeps the hope alive for a soft landing as well as a likely cut in the Fed’s policy rate at its September meeting. Next week is busy too with consumer confidence and ISM data as well as a FOMC rate decision on Wednesday and the June Employment report capping things off on Friday morning. Interest rate futures as of this Friday morning are pricing a 95+% chance that the Fed holds the policy rate steady next week.

Issuance

It was a solid week for new supply with $29.5bln of new debt hitting the market, although this fell short of the $35bln estimate. UnitedHealth led the way, pricing a $12bln issue to fund M&A, the 4th largest deal of 2024. Occidental Petroleum also priced a chunky $5bln new deal. Next week syndicate desks are looking for $25bln of new debt. If that figure comes to pass then this July will rank among the busiest ever and will challenge the record that was set for July in 2017 when companies priced $122bln. July can often be a slow month for new issue supply but this year has been anything but. The year-to-date issuance tally has now climbed to $964bln which is more than 25% ahead of where things stood at this point last year.

Flows

According to LSEG Lipper, for the week ended July 24, investment-grade bond funds reported a net outflow of -$0.034bln. Short and intermediate investment-grade bond funds have seen positive flows 25 of the past 30 weeks. YTD flows into IG stand at +$39.8bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.