CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

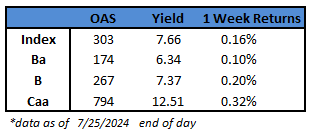

- US junk bonds are poised to see their eighth straight weekly gains, potentially the longest such streak since January 2021, while spreads continue to hang around 300 basis points on interest-rate cut expectations.

- A survey of US economists showed that the expectation that the Federal Reserve will likely signal its plans to cut interest rates in September in the policy meeting next week. They said the US central bank will use the July 30-31 gathering to set the stage for a quarter-point cut at the following meeting.

- Bloomberg Economics’ Anna Wong expects core June PCE inflation — the Fed’s preferred price gauge — to slow to near the central bank’s 2% target on a three-month annualized basis. Also, expects details to show household finances are increasingly stretched. Together, these may persuade the Fed to begin easing rates in September

- While the high-yield market recorded negligible losses on Thursday, yields are still just six basis points away from the year-to-date low of 7.60% and are likely to end the week unchanged at 7.66%

- The gains for the week extend across ratings. CCCs, the riskiest tier of the junk-bond market, are on track to rally for the fourth straight week, the longest such streak since March. Yields are still near their five-week low and spreads unchanged at 794 basis points, also a four-week low

- BBs are also poised for their ninth consecutive weekly gains, the longest stretch in more than three years, even after registering small losses in the last two sessions

- BB spreads closed unchanged at 174 basis points, just six basis points above the four-year low of 168. Yields also held steady 6.34%, a mere six basis points away from the 17-month low of 6.26%

- Credit spreads remain relatively stable, despite a sharp pickup in equity volatility, Brad Rogoff and Dominique Toublan of Barclays wrote in a note Friday

- Still-compressed spreads, attractive all-in yields and light supply lured investors to high yield market, with US high yield funds reporting a cash intake of $1.5b for week ended July 24. This is the third straight week cash inflows into the junk bond funds

- The primary market, though winding down for the summer, has seen 10 deals price for $5.5b this week

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.