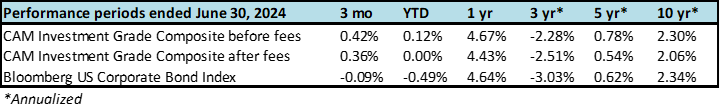

2024 Q2 Investment Grade Quarterly

The second quarter of the year was similar to the first. Credit spreads remained in a tight range and stubbornly higher Treasury yields continued to be a thorn in the side of total returns. Investors have begun to accept that the bar for an easing cycle is high though the data has been more cooperative lately in helping the Fed to reach that goal. We continue to believe that the current environment is opportunistic for bond investors but it may require patience. IG credit will likely be a carry trade until the Fed starts to move the policy rate lower. Elevated yields and higher coupons could be a boon for investors that use bonds as a mechanism to preserve capital.

Second Quarter Review

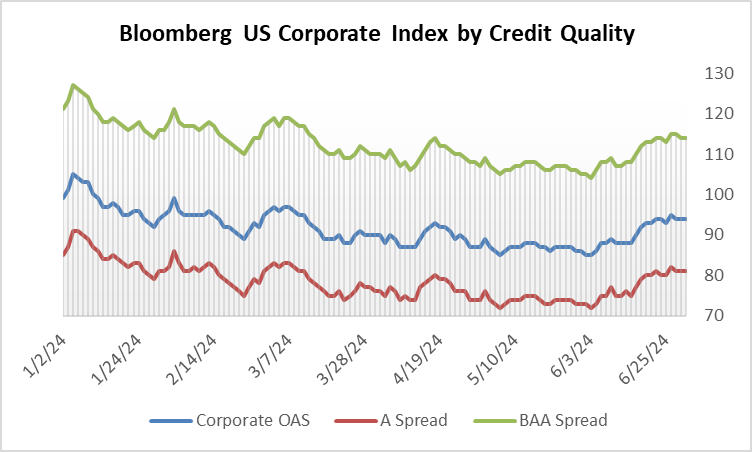

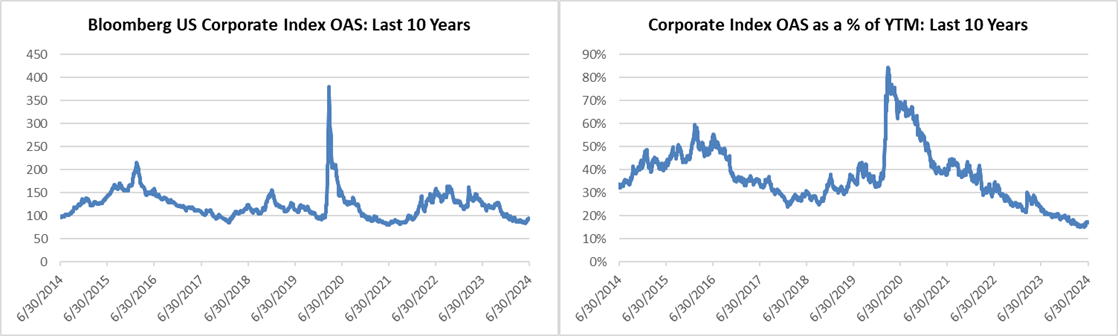

The option adjusted spread (OAS) on the Bloomberg US Corporate Bond Index opened the second quarter at 90 and traded as tight as 85 in early June before finishing the quarter at a spread of 94. Recall that the index began 2024 at a spread of 99 and briefly traded as wide as 105 in early January before it started its march tighter. Spreads traded in a narrow band during the second quarter where the corporate OAS for the index was rangebound to the tune of only 10 basis points during the period.

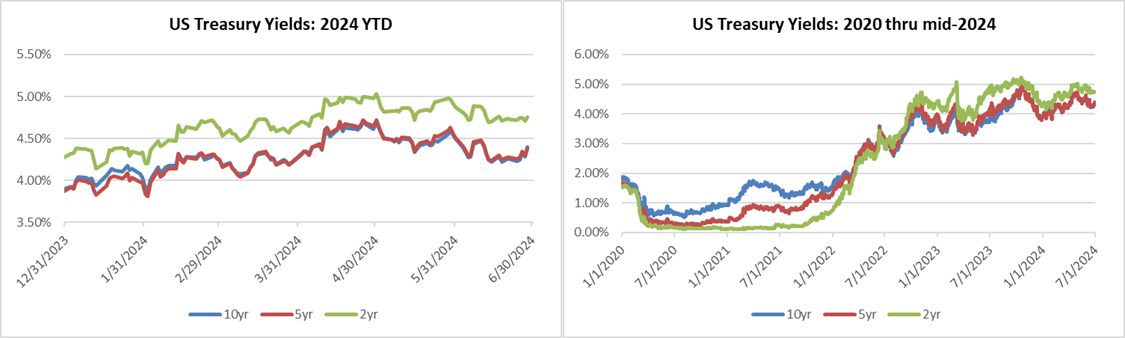

Treasury yields continued to grind higher in the second quarter which has been the principal reason that year-to-date total returns for the IG index were modestly negative. Yields were higher during the first quarter and that theme continued during the second quarter.

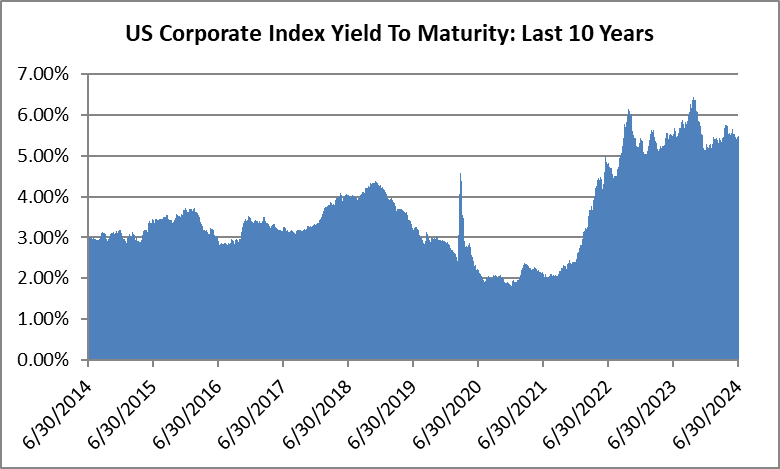

The below chart is illustrative of where Treasury yields were prior to and during the coronavirus pandemic –meaningfully lower back then relative to the present.

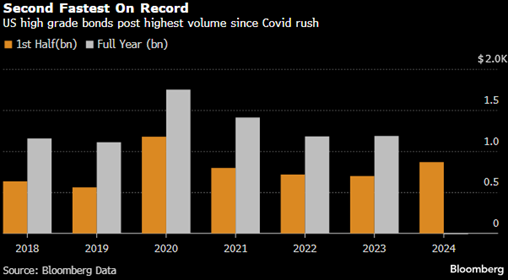

Corporate issuance remained strong during the second quarter but could not keep up with the record-breaking pace of the first quarter. Year-to-date new issue volume was $867 billion at the end of the second quarter. There are several reasons behind the robust environment for issuance and companies’ eagerness to issue debt. On the demand side inflows for the investment grade asset class have been strong with over $200bln into taxable bond funds through the end of May (June flow data was not yet available at the time of publication). Additionally, insurance companies have been strong buyers of bonds on the back of premium rate increases and pension funds have been allocating to a variety of fixed income asset classes as they look to rebalance their portfolios to account for strong equity performance in 2023 and the first half of 2024. Foreign buyers have also been participating in the US corporate market as the ECB and some other central banks in Europe and elsewhere have started to ease by cutting their policy rates which has made dollar-denominated bonds more attractive than the bonds of some other currencies. From the standpoint of borrowers although the all-in yields that they are paying are elevated compared to the recent past spreads are snug. Most investment grade balance sheets are healthy enough to borrow at current rates and the cost of debt is reasonable and within capital allocation frameworks for many stronger companies. Another factor driving issuance is future uncertainty: many management teams would rather borrow funds now in a relatively low volatility environment. A US presidential election, a potential Fed easing cycle, and an economy that could start to show the strain of higher rates could make it more difficult or expensive to access capital in the second half of the year.

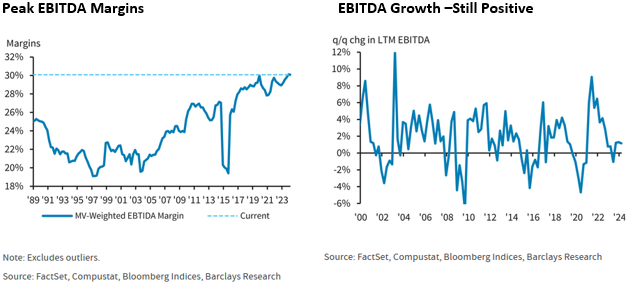

Investment grade credit metrics remained on solid footing at the end of the first quarter. EBITDA margins were very close to all-time highs and EBITDA growth was still positive albeit at a slower pace than the previous quarter. It wasn’t all rosy though as cash balances fell slightly and net leverage increased which had a negative impact on interest coverage. We feel quite good about the health of IG corporate credit broadly speaking but as an active manager we seek to invest in companies with stable or improving credit metrics and eschew those that are struggling to perform.

Fed Update – Still on Hold

Investor views have evolved and they are now in a much more realistic place with regard to a potential easing cycle relative to where they started the year. Recall that back then interest rate futures markets were implying as many as seven 25bp rate cuts. The Fed’s own projections have been more pragmatic than investors. The Fed dot plot median consensus showed expectations for 3 rate cuts at its December 2023 update and then again at its March 2024 update. The Fed tempered its expectations in June 2024 with a further adjustment to the dots that showed a close call between one or two cuts in the second half of 2024. Out of the 19 FOMC members, eight expected two cuts, seven projected one, and four believe that there will be none at all. Investors have acquiesced and interest rate futures at the end of the second quarter showed a 56% probability of a cut in July and a 75% probability of a cut in December. The Fed would love to join the list of central banks that have cut rates that includes the ECB, Canada, Czech Republic, Hungary, Sweden, and Switzerland but this is a FOMC that understands and appreciates the mistakes of the past. We continue to expect one or two cuts in 2024 although we would note that there are only four opportunities left for this to happen because the FOMC does not meet in August or October. We continue to believe that the longer the Fed waits to cut the more likely it will result in an economic slowdown and we are managing the portfolio with this in mind.

Coupon vs. Total Return

With the Fed in a holding pattern what does it mean for investment grade credit? We believe that it has created an environment where the bulk of investor returns in the near term will come in the form of coupon while they are paid to wait for the likely start of an easing cycle and yield curve normalization. The average coupon on the index at the end of the second quarter was 4.2% up from 3.9% and 3.6% at the end of June 2023 and June 2022 respectively. But this does not tell the whole story as the coupon for intermediate maturity debt that is being issued today is virtually guaranteed to have a higher coupon than the average which is artificially low due to the amount of debt that issued during the era of ultra-low interest rates. A better way to look at the coupon available to investors in the market today is to use the average yield to maturity (YTM%) for the index as a proxy for coupon. Average YTM% finished the second quarter at 5.48% which is a good approximation of what it would cost an average investment grade rated company to issue debt today.

We have beaten the drum on this point for the past few quarters: as the above chart illustrates there have been limited opportunities during the past decade for investors to deploy capital at these yields and coupons. In a simplified example if an investor has a bond portfolio with an average coupon of 5% and the prices of the bonds in that portfolio do not change at all during the year then that investor earns a one-year total return of 5% in the form of coupon income. A coupon above 5% for IG credit is very attractive in our view and provides the investor with a good chance to generate positive total returns over time as well as a higher degree of downside protection that was unavailable a few years ago when interest rates were much lower.

Spreads vs. Yields

Although yields are near the high end of their historical range spreads are near the tight end. The following two charts show the level of spreads for the index as well as the percentage of the portion of the index yield that is represented by credit spread. For example if an investor buys an investment grade corporate bond at a spread of 100 basis points over the 10yr Treasury at 4.40% then the yield for that corporate bond is 5.40% and 18.5% of that yield is from credit spread. Tight spreads and elevated Treasury yields have created an environment where a relatively small portion of an investor’s overall compensation is derived from spread today.

Credit spread is the compensation an investor receives in exchange for taking the credit risk of owning a corporate bond versus taking no credit risk at all for owning the underlying Treasury (the risk-free rate). There are a few reasons that spreads are tight today. First and foremost financial conditions for investment grade rated borrowers are good and we discussed some of those metrics earlier in this note. Secondly, the default rate for investment grade rated companies has historically been exceedingly low so it is typical for spreads to be tight when the economy is growing and corporate balance sheets are healthy. Finally an environment of elevated Treasury yields can lend itself to tight credit spreads. This is because there is a large base of buyers in the investment grade market that care more about all-in yields than they do about spreads. These investors may have a yield bogey or a hurdle rate that they need to clear for an investment making them agnostic about spreads but more sensitive to yields. As professional bond managers spreads are very important to us because we use them to assess the relative value of individual bonds when we evaluate them for purchase or for sale. Whether you care about spread yield or both; the bottom line is that investors are currently being well compensated for owning IG credit in the form of coupon and yield even if spreads are tight.

Second Half Outlook

The second half of the year could be volatile with several big events on the horizon. For the first time in a while we are starting to see pockets of legitimate economic uncertainty. On one hand the economy has been resilient. But questions remain about the ability for economic perseverance in the face of an extended financial tightening cycle that began in March of 2022. The consumer drives the US economy and they have kept spending but how long can they continue to do so now that excess savings have been exhausted and with a current savings rate that has been steadily negative? Labor market data has weakened slightly in recent months but the unemployment rate is still near the low end of its historical range. We are not one to cry wolf and we do not think we are on the brink of economic malaise but we see a lot less room for error today for the economy than at any point since before 2020. Many consumers are stretched with little cushion and a pullback in wages and/or employment could tip the economy into a recession.

Given this backdrop we are populating investor portfolios accordingly and are seeking to avoid companies and industries that are discretionary in nature. We are still taking appropriate risks but only if the compensation is commensurate. Thank you for our continued interest. We look forward to collaborating with you as we navigate the credit markets together. As always please reach out with any questions or topics for discussion.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice as are statements of financial market trends which are based on current market conditions. This material is not intended as an offer or solicitation to buy hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees expenses and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. As part of educating clients about CAM’s strategy we may include references to historical rates and spreads. Hypothetical examples referencing the level of, or changes to, rates and spreads are for illustrative and educational purposes only. They are not intended to represent the performance of any particular portfolio or security, nor do they include the impact of fees and expenses. They also do not take into consideration all market and economic conditions that influence our decision-making. Therefore, client accounts may or may not experience scenarios similar to those referenced herein.

Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/

i Bloomberg, June 28 2024 “High-Grade Bond Sales on Easter Pause After Record First Quarter”

ii Bloomberg WIRP, March 29 2024 “Fed Funds Futures”

iii Bloomberg WIRP, June 29 2024 “Fed Funds Futures”

iv Raymond James & Associates, June 28 2024 “Fixed Income Spreads”

v Barclays Bank PLC, June 13 2024 “US Investment Grade Credit Metrics, Q2 2024 Update: No Concerns”

vi J.P. Morgan, July 3 2024 “US High Grade Corporate Bond Issuance Review”

vii Bloomberg ILM3NAVG Index, June 28 2024 “Bankrate.com US Home Mortgage 30 Year Fixed National Avg”

viii CNBC, June 13 2024 “The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reeling”