2024 Q2 High Yield Quarterly

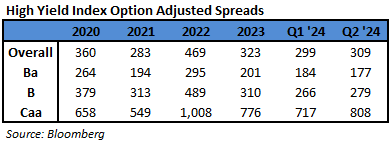

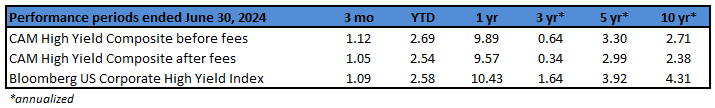

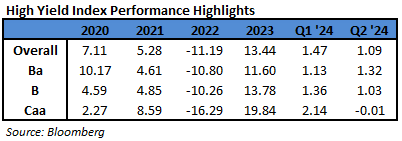

In the second quarter of 2024, the Bloomberg US Corporate High Yield Index (“Index”) return was 1.09% bringing the year to date (“YTD”) return to 2.58%. The S&P 500 index return was 4.28% (including dividends reinvested) bringing the YTD return to 15.29%. Over the period while the 10-year Treasury yield increased 20 basis points the Index option adjusted spread (“OAS”) widened 10 basis points moving from 299 basis points to 309 basis points.

With regard to ratings segments of the High Yield Market, BB rated securities tightened 7 basis points, B rated securities widened 13 basis points, and CCC rated securities widened 91 basis points. The chart below from Bloomberg displays the spread moves in the Index over the past five years. For reference, the average level over that time period was 405 basis points.

The sector and industry returns in this paragraph are all Index return numbers. The Index is mapped in a manner where the “sector” is broader with the more specific “industry” beneath it. For example, Energy is a “sector” and the “industries” within the Energy sector include independent energy, integrated energy, midstream, oil field services, and refining. The Consumer, Non-Cyclical, Other Financial, and Brokerage sectors were the best performers during the quarter, posting returns of 2.54%, 2.42%, and 2.35% respectively. On the other hand, Communications, REITs, and Transportation were the worst performing sectors, posting returns of -1.76%, 0.52%, and 0.55% respectively. At the industry level, pharma, other industrial, and leisure all posted the best returns. The pharma industry posted the highest return of 9.49%. The lowest performing industries during the quarter were wirelines, media, and cable. The wirelines industry posted the lowest return of -3.01%.

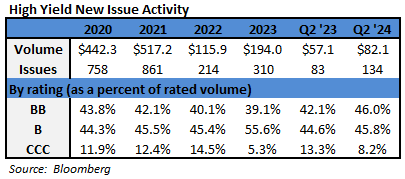

The year continued with strong issuance during Q2 after the very strong start that took place in Q1. The $82.1 billion figure is the most volume in a quarter since the fourth quarter of 2021, not counting Q1 this year. Of the issuance that did take place during Q2, Discretionary took 22% of the market share followed by Financials at 20% share and Energy at 16% share.

The Federal Reserve did hold the Target Rate steady at the May and June meetings. There was no meeting held in April. This made seven consecutive meetings without a hike. The last hike was back in July of 2023. The Fed dot plot shows that Fed officials are forecasting 25 basis points in cuts during 2024 down from a 75 basis cut forecast at the beginning of this year. Market participants have continued to reign in their own expectations of cuts during 2024 based on the pricing of Fed Funds Futures. At the start of the year participants expected over 150 basis points in cuts during 2024; however the expectation is now down to approximately 45 basis points in cuts this year. After the June meeting, Chair Powell commented “the most recent inflation readings have been more favorable than earlier in the year.” He continued “there has been modest further progress toward our inflation objective. We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.” The Fed’s main objective has been lowering inflation and it continues to generally trend in the desired direction. The most recent report for Core CPI showed a year over year growth rate of 3.4% down from a peak of 6.6% almost two years ago. Further, the most recent Core PCE growth rate measured 2.6% off the peak of 5.6% from February of 2022.

Intermediate Treasuries increased 20 basis points over the quarter as the 10-year Treasury yield was at 4.20% on March 31st and 4.40% at the end of the second quarter. The 5-year Treasury increased 17 basis points over the quarter moving from 4.21% on March 31st to 4.38% at the end of the second quarter. Intermediate term yields more often reflect GDP and expectations for future economic growth and inflation rather than actions taken by the FOMC to adjust the target rate. The revised first quarter GDP print was 1.4% (quarter over quarter annualized rate). Looking forward, the current consensus view of economists suggests a GDP for 2024 around 2.3% with inflation expectations around 2.8%.

Being a more conservative asset manager, Cincinnati Asset Management does not buy CCC and lower rated securities. Additionally, our interest rate agnostic philosophy keeps us generally positioned in the five to ten year maturity timeframe. During Q2, our higher quality positioning served clients well as lower rated securities underperformed but maturity positioning was a detractor as the less than three year timeframe bucket outperformed. Additionally, there was a performance drag due to our credit selections within the consumer non-cyclical and energy sectors. Benefiting our performance this quarter were our credit selections in the communications sector and our underweight in the communications sector.

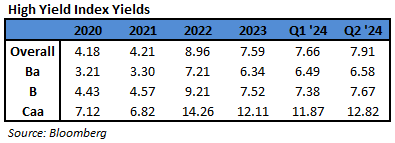

The Bloomberg US Corporate High Yield Index ended the second quarter with a yield of 7.91%. Treasury volatility as measured by the Merrill Lynch Option Volatility Estimate (“MOVE” Index) has picked up quite a bit the past couple of years. The MOVE averaged 121 during 2023 relative to a 62 average over 2021. However, the current rate of 98 is well below the spike near 200 back during the March 2023 banking scare. Data available through May shows 11 defaults during 2024 which is relative to 16 defaults in all of 2022 and 41 defaults in all of 2023. The trailing twelve month dollar-weighted default rate is 2.52%. The current default rate is relative to the 1.74%, 1.93%, 2.37%, 2.53% default rates from the previous four quarter end data points listed oldest to most recent. While defaults are ticking up, the fundamentals of high yield companies still look good. From a technical view, fund flows were positive in the quarter at $3.3 billion. No doubt there are risks but we are of the belief that for clients that have an investment horizon over a complete market cycle, high yield deserves to be considered as part of the portfolio allocation.

The high yield market continues to hum along with positive performance and attractive yields. Corporate fundamentals are broadly in good shape, defaults held steady this quarter and issuance remains robust. While GDP still looks good there are some items to note that are relevant to the consumer namely rising delinquencies, depleted excess savings from the pandemic, and an unemployment rate that is on the rise. These items are likely to weigh on the data dependent Fed to commence rate cuts. Among others, the ECB and Bank of Canada have already enacted rate cuts. Looking ahead, the second half of the year contains some events of interest including the presidential election and the probable start of a US rate reduction cycle. Our exercise of discipline and credit selectivity is important as we continue to evaluate that the given compensation for the perceived level of risk remains appropriate. As always, we will continue our search for value and adjust positions as we uncover compelling situations. Finally, we are very grateful for the trust placed in our team to manage your capital.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice as are statements of financial market trends which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise, the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/

i Bloomberg, June 28 2024 “High-Grade Bond Sales on Easter Pause After Record First Quarter”

ii Bloomberg WIRP, March 29 2024 “Fed Funds Futures”

iii Bloomberg WIRP, June 29 2024 “Fed Funds Futures”

iv Raymond James & Associates, June 28 2024 “Fixed Income Spreads”

v Barclays Bank PLC, June 13 2024 “US Investment Grade Credit Metrics, Q2 2024 Update: No Concerns”

vi J.P. Morgan, July 3 2024 “US High Grade Corporate Bond Issuance Review”

vii Bloomberg ILM3NAVG Index, June 28 2024 “Bankrate.com US Home Mortgage 30 Year Fixed National Avg”

viii CNBC, June 13 2024 “The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reeling”