CAM Investment Grade Weekly Insights

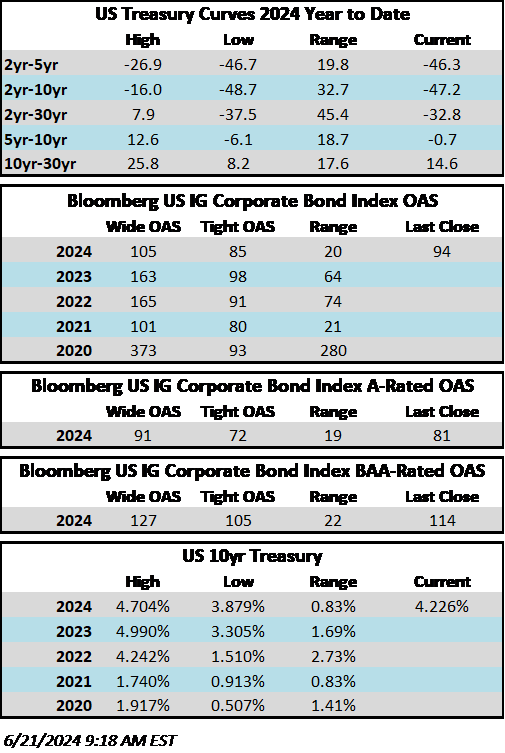

Credit spreads moved incrementally wider for the second consecutive week. The Bloomberg US Corporate Bond Index closed at 94 on Thursday, June 20, after closing the week prior at 92. It isn’t shocking to see spreads take a breather as they have been at tight levels relative to historical trading ranges, and they have widened in concert with Treasury yields, which have decreased in recent weeks. The 10-year Treasury yield is nearly unchanged on the week, trading at 4.23% this Friday morning after closing last week at 4.22%. Through Thursday, the corporate bond index YTD total return was +0.16% while the yield-to-maturity for the benchmark was 5.39%. All-in yields remain elevated relative to the recent past – the average yield on the corporate index over the past 10 years was 3.56%, 183 bps lower than the yield available to investors today.

Economics

It was another busy week for economic data with a bevy of highlights. On Monday, we got an Empire Manufacturing print for that region that was better than feared but still showed contraction. Retail sales on Tuesday missed to the downside, and the release was also accompanied by downward revisions to previous months. It is too early to tell, but some economists believe that this could be the beginning of a sustained softening in consumer sentiment. On Thursday, we got housing data that showed new construction starts hit a four-year low. Lastly, on Friday, S&P’s data showed that U.S. services activity expanded in a broad-based way so far during the month of June. Positively, the survey also showed further softening of price pressures and a rebound in domestic manufacturing activity. Next week is pretty quiet on the data front until Thursday’s GDP and core PCE releases.

Issuance

The IG primary market rebounded this week as companies priced $31.4 billion of new debt – an impressive haul in a holiday-shortened week. We were unsure if issuance would really come through due to a spate of economic data and a looming summer slowdown, but Monday got the week off to a hot start as 13 issuers priced more than $21 billion. Next week, syndicate desks are looking for around $20 billion of issuance, but all it takes is one big issuer to push that total higher, much like we saw with Home Depot this week, which issued $10 billion on Monday to fund its acquisition of SRS Distribution.

Flows

According to LSEG Lipper, for the week ended June 19, investment-grade bond funds reported a net outflow of -$0.433 billion. This was the first outflow from IG funds in over a month, which have seen positive flows 22 of the past 25 weeks. YTD flows into IG stand at +$36.8 billion.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.