CAM Investment Grade Weekly Insights

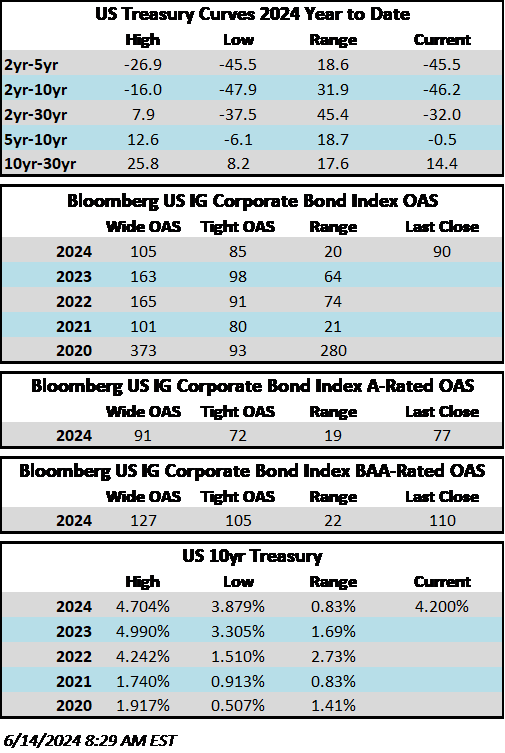

Credit spreads are slightly wider on the week. The Bloomberg US Corporate Bond Index closed at 90 on Thursday June 13 after closing the week prior at 88. Although this was the widest level for the index since late April, it is only 5bps off the tightest levels of the year which illustrates just how “unchanged” the index has been for the past month and a half. The 10yr Treasury yield is lower this week, trading at 4.20% this Friday morning after closing last week at 4.43%. Through Thursday, the corporate bond index YTD total return was +0.41% while the yield-to-maturity for the benchmark was 5.33%.

Economics

There was a bounty of economic data this week with the biggest events occurring on Wednesday and Thursday. Core CPI Inflation data for May was released on Wednesday morning, declining to +0.2% MoM relative to consensus of +0.3%. This deceleration was a welcome relief on the heels of some hotter prints earlier this year. However, this was just one data point and it does not make a trend. On Wednesday afternoon the FOMC released its policy decision with no change in the Fed Funds rate, as expected. The press conference was on script but there were some notable changes in the Summary of Economic Predictions (SEP aka The Dot Plot). The SEP showed slightly higher Fed inflation forecasts for 2024 and 2025 and a move in the median number of cuts for 2024 from 3 to 1. Interestingly, 4 of the 19 FOMC members are now expecting no cuts in 2024, which was up from 1 member in March. Recall that the SEP is released every three months so the next update will not occur until September 18. Thursday morning brought more good news on the inflation front as the PPI release showed that US producer prices declined in May by the most in seven months. PPI for May came in at -0.2% versus the estimate of +0.1% but nearly 60% of the decline in the May PPI for goods was due to declining gasoline costs. Next week is another busy one for economic data with empire manufacturing, retail sales, housing starts and global PMI, to name a few.

Issuance

The IG primary market was extremely slow this week as borrowers priced just $5.75bln in new debt. According to Bloomberg, excluding seasonality and holiday-shortened weeks, this was the lowest volume total since borrowers raised $4.25bln in the week ended 12/9/2022. The low issuance tally was really much ado about nothing: with CPI/Fed on Wednesday, that day was effectively closed to borrowers. Interest rate volatility plus the beginning of summer seasonality likely kept a few issuers at bay on the other days. Year-to-date issuance remains robust, standing at $803bln YTD, up +20% relative to 2023. Next week, dealers are calling for $25-$30bln in new supply. While we expect some issuance as borrowers look to take advantage of lower borrowing costs, we are skeptical that it will be that strong of a week given the busy economic calendar and the fact that bond and equity markets are closed on Wednesday in observance of Juneteenth.

Flows

According to LSEG Lipper, for the week ended June 12, investment-grade bond funds reported a net inflow of +$0.989bln. IG funds have seen positive flows 22 of the past 24 weeks. YTD flows into IG stand at +$37.2bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.