CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

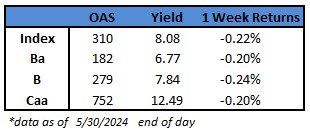

- US junk bonds are headed to reverse April’s losses and record modest gains for the month of May, shrugging off the supply deluge as yields held steady and spreads hovered near 300 basis points.

- The primary market was inundated with new supply amid steady and near-historic tight spreads and attractive yields. The market priced more than $31b to make it the busiest month since September 2021. Attractive all-in yields acted as the stabilization factor for credit spreads, Barclays analysts Brad Rogoff and Dominique Toublan wrote earlier this month.

- Tight spreads are here to stay amid the absence of big leveraged buyouts and corporate mergers, Rogoff and Toublan wrote in a separate report Friday morning, citing their meetings with clients at the leveraged finance conference last week

- The supply deluge saw more than $13b price in the second week of May alone, the busiest week for issuance since October 2021. Two of the five weeks priced more than $10b

- Yields were largely range-bound since the Fed meeting in early May after Fed Chair Powell indicated on May 1 that a hike in interest-rates was unlikely

- Yields advanced to near 8% last week and crossed the 8% level this week after an array of Fed speakers turned hawkish and signaled that rates are likely to stay higher for longer

- Vice Chair for Supervision Michael Barr said that policymakers need to hold interest rates steady for longer than previously thought in order to fully cool inflation

- Cleveland Fed chief Loretta Mester, speaking at a panel moderated by Atlanta Fed President Raphael Bostic, said Tuesday that she wants to see “a few more months of inflation data that looks like it’s coming down” before cutting interest rates

- Federal Reserve Bank of Minneapolis President Neel Kashkari warned that the policymakers at the Federal Reserve have not ruled out additional interest-rate increases

- Atlanta Fed President Raphael Bostic said “ we still have a ways to go” to curb the significant price growth seen over the last few years

- Yields on the broad US junk bond index were down 3 bps for the month, though they climbed above 8% after staying in the range of 7.80%-7.90%

- BB yields dropped 12 basis points for the month to 6.77% after falling to 6.56% in the middle of the month, driving gains of 0.99% for May

- But CCC yields surged to a four-month high of 12.49%, rising 21 basis points month-to-date. Still, CCCs amassed gains of 0.32% for the month

- Single B yields fell 12 basis points to 7.84% and spreads were below 300 basis points, pushing gains of 0.76% for the months

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results