CAM Investment Grade Weekly Insights

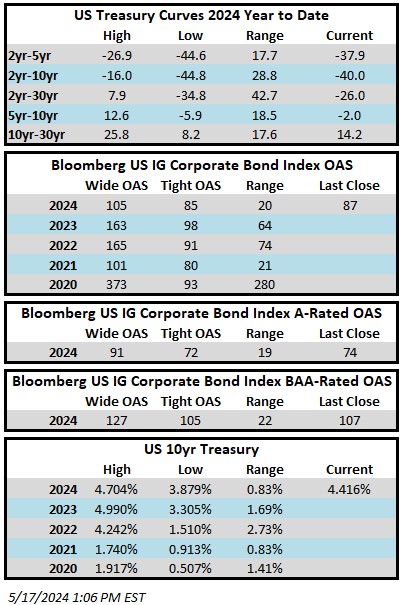

Credit spreads have exhibited little change this week. The Bloomberg US Corporate Bond Index closed at 87 on Thursday May 16 after closing the week prior at the same level. The 10yr Treasury yield is lower this week, trading at 4.42% this Friday afternoon after closing last week at 4.50%. Through Thursday, the corporate bond index YTD total return was -0.74% while the yield-to-maturity for the benchmark was 5.44% relative to its 5-year average of 3.69%.

Economics

It was an action-packed week for data with a hot Producer Price Index (PPI) print kicking things off on Tuesday. Market participants were on guard following PPI as many were expecting a similar surprise to the upside for the Wednesday CPI release. Instead, we got a relatively benign CPI number with weaker than expected inflation. Wednesday also saw a retail sales release which showed a decline in April and it was also accompanied by downward revisions for sales during the first quarter. The inflation and sales releases are dovish indicators and Treasury yields subsequently declined after those Wednesday releases, recouping some of the sell-off in rates that occurred after the hot PPI release early on Tuesday. The next couple weeks are relatively light on the data front and the next Fed meeting on June 12 will be here before we know it.

Issuance

The IG primary market saw good activity on the week as 21 companies sold just over $28bln in new debt. Syndicate desks are looking $25bln next week but that number could surprise to the upside as earnings season is winding down and there is no major economic data that will preclude issuers from tapping the market on any given day. Year-to-date issuance stands at $719.8bln, well ahead of last year’s pace.

Flows

According to LSEG Lipper, for the week ended May 15, investment-grade bond funds reported a net outflow of -$1.04bln. IG funds have seen positive flows 18 of the past 20 weeks. YTD flows into IG stand at +$33.6bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.