CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds barely finished higher Thursday, the third time this week that’s been the case, but the market has yet to fall this week and is poised for its third up week in the past four.

- An array of economic data this week signaled a slow start to 2Q for the US economy, spurring speculation Federal Reserve policymakers may gain confidence about starting to cut rates. The minutes for the latest FOMC meeting are due May 22.

- The data have helped fuel risk-on sentiment, with equities briefly reaching record highs, and push down Treasury yields about 10 basis points this week.

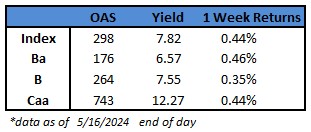

- CCCs have returned 0.44% so far this week with a yield of 12.27%.

- BB yields have fallen 10 basis points to at a near-seven-week low of 6.57% while posting similar returns to CCCs.

- Single B yields have dropped even more, 17 basis points to 7.55%, and returned 0.35% so far this week.

- Issuance has slowed following last week’s bounty, with six borrowers selling more than $3b of new notes this week.

- This week’s lighter supply helped bolster this week’s returns.

- Barclays on Friday revised its year-end spread forecast for high yield to 295-315 basis points, implying total returns of 5%-5.5%.

(Bloomberg) US Inflation Ebbs for First Time in Six Months in Relief for Fed

- A measure of underlying US inflation cooled in April for the first time in six months, a small step in the right direction for Federal Reserve officials looking to start cutting interest rates this year.

- The so-called core consumer price index — which excludes food and energy costs — climbed 0.3% from March, snapping a streak of three above-forecast readings which spurred concern that inflation was becoming entrenched. The year-over-year measure cooled to the slowest pace in three years, Bureau of Labor Statistics figures showed.

- The Fed is trying to rein in price pressures by weakening demand across the economy. Another report out Wednesday showed retail sales stagnated in April, indicating high borrowing costs and mounting debt are encouraging greater prudence among consumers.

- While the figures may offer the Fed some hope that inflation is resuming its downward trend, officials will want to see additional readings to gain the confidence they need to start thinking about cutting interest rates. Chair Jerome Powell said Tuesday the central bank will “need to be patient and let restrictive policy do its work,” and some policymakers don’t expect to cut rates at all this year.

- “It does open the door to a potential rate cut later in the year,” said Kathy Jones, Charles Schwab’s chief fixed-income strategist. “It will take a few more readings indicating that inflation is coming down for the Fed to act.”

- Traders boosted the odds of a September rate cut to about 60%.

- Core CPI over the past three months increased an annualized 4.1%, the smallest since the start of the year.

- Economists see the core gauge as a better indicator of underlying inflation than the overall CPI. That measure climbed 0.3% from the prior month and 3.4% from a year ago. Shelter and gasoline accounted for over 70% of the increase, the BLS said in the report.

- Additionally, the advance in the CPI was driven once again by services like car insurance and medical care.

- Shelter prices, which is the largest category within services, climbed 0.4% for a third month. Owners’ equivalent rent — a subset of shelter, which is the biggest individual component of the CPI — rose by a similar amount. Robust housing costs are a key reason why inflation not only in the US, but also in many other developed economies has refused to ebb.

- The personal consumption expenditures price index, doesn’t put as much weight on shelter as the CPI does. That’s part of the reason why the PCE is trending closer to the Fed’s 2% target.

- A report Tuesday showed producer prices rose in April by more than projected, but key categories that feed into the PCE were more muted. Combined with CPI components that also inform the PCE calculation, economists expect that measure to come in softer when April data is released later this month.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.