CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- Weekly US junk-bond supply rose to almost $13 billion, making it the busiest week for new bond sales since the week ended Oct. 1, 2021.

- The supply spurt came after junk bonds racked up the strongest weekly returns since December on expectations that the Federal Reserve may begin to lower interest rates by the end of third quarter as inflation slows while the economy stays resilient.

- The cascade of new issuance drove the month’s tally to more than $14b in just seven sessions, more than 63% of the full month of May 2023 with three full weeks still to go. Month-to-date volume is up by 59% versus the comparable period a year ago

- Five companies sold nearly $2b Thursday to take the week’s volume to $12.8b. For the week, 18 borrowers came to market

- The recent rally stalled after a three-day gaining streak and is poised to close the week with modest gains after strong returns last week

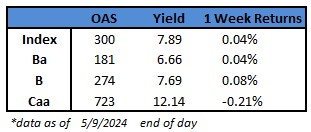

- Though the rally faded across ratings, US borrowers capitalized on the strong risk appetite with spreads around 300 basis points and yields holding steady below 8% in the context of a strong and resilient economy

- CCC yields closed at 12.14% and spreads at 723 basis points, up six and seven basis points, respectively, this week so far pushing week-to-date loss to -0.21% and ending the two-week gaining stretch

- Demand for credit remained robust and investors absorbed the higher-than-expected issuance with limited effects on the secondary market, Brad Rogoff and Dominique Toublan of Barlcays wrote Friday

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.