CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

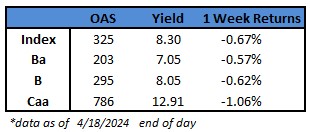

- US junk bonds are headed for the third weekly loss — and the biggest since January — as yields soar to a more than four-month high on geopolitical tensions and concerns about interest rates staying higher for longer and stubborn inflation. Yields, which have risen for seven straight sessions, are at 8.30% and spreads widened to 325 basis points.

- Rising yields and widening spreads against the backdrop of strong data and decent corporate earnings have fueled supply. The primary market has seen more than $8b priced this week

- Month-to-date supply stands at $21b and year-to-date volume to $106b

- The primary market seemed resilient even after Federal Reserve Chair Jerome Powell signaled that the Fed will wait longer than previously anticipated to cut interest rates after a series of surprisingly high inflation readings

- The market also shrugged off geopolitical conflicts on expectations that diplomacy will prevail and escalation would be stopped in its tracks

- Losses spanned across ratings. CCC yields approached 13%, a four-month high, after advancing 50 basis points week-to-date. Yields have risen for seven days in a row, the longest rising stretch in more than a year. Spreads jumped to an eight-week high of 786 basis points

- CCCs suffered losses for the seventh consecutive session and are headed toward the third week of losses. Week-to-date losses stood at 1.06%, the most in a week since early January

(Bloomberg) Bond Funds Dangling 5% Yields Lure Cash to Active Managers

- About $90 billion flowed into active bond funds in the first quarter, the most for any three-month period since mid-2021. With yields now at their highest in almost two decades, fund managers see a window of opportunity for investors to lock in outsize returns before the Federal Reserve fulfills its promise to cut rates.

- The fresh inflows mark the start of “a longer multi-quarter and potentially multi-year trend out of cash,” said Ryan Murphy, head of fixed-income business development at Capital Group, the Los Angeles-based bond colossus. While many investors are still cautiously favoring cash, the rising payouts on debt securities should encourage more to shift their money into bonds, according to Murphy. “Investors are getting the best compensation on fixed income in 20 years,” Murphy said.

- While the sums are substantial, the real prize for bond managers is getting investors to shift out of money-market funds, which had been holding more than $6 trillion. It’s dropping now — the latest data Thursday showed the largest weekly decline in short-term cash holdings since September 2008.

- Bond buying right now is a tricky calculus for individual investors, in part because the timing and number of rate cuts keeps getting pushed back, with the latest delay signaled by Fed Chair Jerome Powell in an April 16 discussion. It also takes no small effort to sort through distorted bond prices and credit quality to find real opportunities.

- All of that favors active managers. “The big picture is that yields are attractive and you need to be an active manager in this environment,” Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management, said in an interview last week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.