CAM Investment Grade Weekly Insights

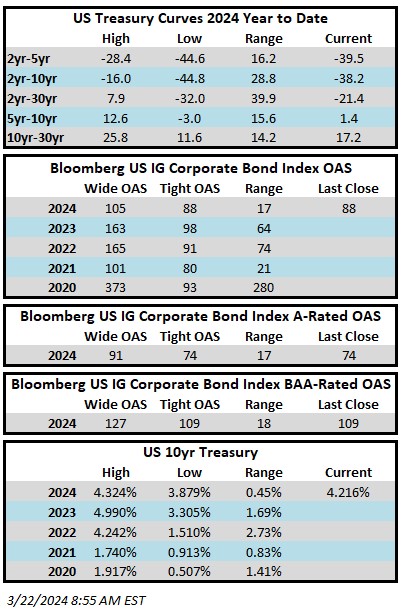

Spreads stuck to a tight range this week and are looking to finish the period at the narrowest levels of 2024. The Bloomberg US Corporate Bond Index closed at 88 on Thursday March 21 after having closed the week prior at 89. The 10yr is trading at 4.22% this Friday morning after closing last week at 4.31%. Through Thursday, the Investment Grade Corporate Index YTD total return was -1.00%. The story remains the same: spreads are tight but yields are elevated. The yield to maturity for the Bloomberg US Corporate Bond index as of Thursday evening was 5.34%.

Economics

It was a light week for economic data but an extremely busy week for central banks throughout the globe. There were rate decisions from Australia, the BOJ, the BOE and of course the FOMC, among others. Chairman Powell walked a tightrope in his press conference and the market interpreted the Fed release as slightly dovish. The Fed made it clear that rate cuts are still on the agenda with its updated dot projections. The market is currently coalescing around 3 cuts for a total of 75bps beginning at the June meeting. This is far from certain in our view and only time (and ensuing economic data) will tell. As of this morning, interest rate futures are implying a 65% chance of a cut in June.

Issuance

Issuance was in-line with estimates on the week as companies priced more than $27bln of new debt. For the year, the torrid pace of issuance has now officially passed the half trillion mark, with 2024 setting a new record for how quickly $500bln was breached. Next week dealers are estimating $20bln of new supply. This number is certainly achievable, especially if Monday is busy, but we would not be surprised if the issuance tally is underwhelming relative to expectations. It is typically a seasonally slow week and the bond market closes early on Friday leaving Monday and Tuesday as the most favorable days for new issue prints.

Flows

According to LSEG Lipper, for the week ended March 20, investment-grade bond funds reported a net inflow of +$1.4bln. This was the 14th consecutive weekly inflow for IG funds. YTD flows into IG stand at +$23.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.