CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

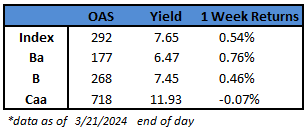

- US junk bond rally came as a lagged response after Federal Reserve Chair Jerome Powell’s reiteration that rate cuts are likely to begin later this year. Yields plunged to a nearly 12-week low of 7.65%, after dropping for four straight sessions, and are on track for the biggest weekly decline in 10 weeks. Spreads tightened to a new two-year low of 292 basis points and are headed for third straight week of decline.

- The broad junk bond gains were powered by expectations that the Fed will steer a soft landing after its officials’ median projection showed three quarter-point cuts in 2024.

- The gains in the US junk bond market spanned across ratings. BB spreads, the most rate sensitive part of the high yield market, dropped to a new four-year low of 177 basis points. Yields closed at 6.47%, falling 19 basis points week-to-date, and are poised for the biggest weekly drop in almost 10 weeks

- The index is headed to end the week with gains of 0.5%, rebounding from last week’s losses and spurred by the Fed’s reiteration that it was appropriate to slow the pace at which the central bank shrinks its balance sheet, suggesting further easing of its restrictive stance

- BBs are poised to close the week with gains of 0.76%, the biggest since week ended Jan. 12, after notching the biggest returns in 11 weeks on Thursday

- Single B yields tumbled to a fresh two-year low of 7.45% and have fallen 16 basis point this week, the biggest weekly decline in eight weeks. Spreads fell to 268 basis points, the lowest since 2007

- CCC yields dropped back to below 12% and closed at 11.93%. Spreads closed at 718 basis points, tightening for the seventh straight week, the longest tightening streak since 2016

- Borrowers and investors are still being drawn to the junk bond market amid steady yields and tightening spreads against the backdrop of a resilient economy and expectations of soft landing

(Bloomberg) Fed Signals Three Cuts Still Likely, Despite Inflation Uptick

- Federal Reserve officials maintained their outlook for three interest-rate cuts this year and moved toward slowing the pace of reducing their bond holdings, suggesting they aren’t alarmed by a recent uptick in inflation.

- Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a fifth straight meeting. Policymakers signaled they remain on track to cut rates this year for the first time since March 2020, but they now see just three reductions in 2025, down from four forecast in December, based on the median projection.

- Chair Jerome Powell, speaking to reporters after the Fed’s decision Wednesday, demurred when asked whether officials would lower rates at their coming meetings in May or June, repeating that the first reduction would likely be “at some point this year.”

- He largely shrugged off recent data showing an uptick in inflation in recent months, saying, “It is still likely in most people’s view that we will achieve that confidence and there will be rate cuts.”

- At the same time, he said the data supported the Fed’s cautious approach to the first rate cut, and added that policymakers are still looking for more evidence that inflation is headed toward their 2% goal.

- Inflation has eased “notably in the past year but remains above our longer-run goal of 2%,” Federal Reserve Chair Jerome Powell said to reporters in Washington.

- Powell also said it would be appropriate to slow the pace of the Fed’s balance-sheet unwind “fairly soon,” after policymakers held a discussion on their asset portfolio this week.

- “The decision to slow the pace of runoff does not mean our balance sheet will shrink, but allows us to approach that ultimate level more gradually,” he said. “In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility of money markets experiencing stress.”

- The Fed’s post-meeting statement was nearly identical to January’s, maintaining the guidance that rate cuts won’t be appropriate until officials have more confidence inflation is moving sustainably toward their 2% target.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.