CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

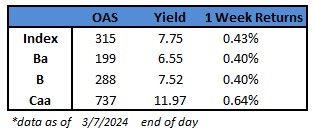

- The US junk bond market is headed toward a third-straight weekly gain, with its current six-day winning streak the longest this year and yields dropping to 7.75%.

- It’s allowed yields for the riskiest part of the market, CCCs, to fall below 12% for the first time this year.

- They’ve fallen 21 basis points so far this week, on top of last week’s 31bp plunge, putting weekly returns at 0.64%.

- CCC notes have had positive returns for 11 consecutive sessions, the longest since June, as it’s the best-performing asset class in US fixed income.

- Spreads have dropped 15 basis points this week to 737, the tightest since May 2022.

- The junk market’s rally gained momentum after Fed Chair Powell told Congress that rate cuts are likely this year and recession risks are not elevated in the near term.

- Jobs data remains robust on the openings and unemployment claims front, ahead of this morning’s employment report for February.

- Steady yields and historically tight spreads across ratings continue to draw borrowers and investors into the market.

- Bloomberg Intelligence analysts Noel Hebert and Sam Geier predicted high-yield bond sales this month will range from 25b-$29b.

- While things may slow some ahead of the next Fed meeting, bankers are prepping to begin a debt sale for the leveraged buyout of Truist Financial’s insurance brokerage business as loans for the deal get done.

- Conversations with investors continue to indicate that yields of 7.8% in high yield and 5.3% in investment grade are attractive enough even though spreads are tight to support strong demand, Barclays’ Brad Rogoff and Dominique Toublan wrote in note this morning.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.