CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- The broad rally in risk assets has propelled CCCs, the riskiest part of the junk bond market, to the top as the best performing asset class in February. Returns for the month were 1.7% after climbing for six consecutive sessions. The gains came after S&P 500 breached the 5,000 level and steadily climbed to close at an all-time high.

- CCC returns turned positive year-to-date for the first time in the last week of February, only to accelerate to rise as the best asset class for total returns in the US fixed income market.

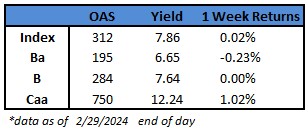

- CCC yields tumbled 43 basis points in February to close at a nine-week low of 12.24% bucking the broader trend as BB yields rose 17 basis points to 6.65%. Single B yields barely moved to close at 7.64%.

- Broad macro economic data reiterated the narrative about strong and resilient growth amid a slower-than-expected decline in inflation. However, robust economic growth, against the backdrop of relatively stable inflation reading, bolstered risk assets across markets.

- The recent outperformance of lower-quality assets has coincided with large gains in some of the riskier and more speculative parts of the market, such as cryptocurrencies, Barclays analysts Brad Rogoff and Dominique Toublan wrote in a Friday note.

- Loose financial conditions continue to support risk-taking in the markets, they wrote.

- Though spreads are historically tight, yields are supporting strong demand, the analysts reiterated again this morning.

- Tight spreads, attractive yields and resilient economy have drawn US borrowers into the market powering a supply boom.

- February supply of almost $27b pushed the year-to-date tally to $58b, a 70% jump year-over year.

- New bond sales in February were up 86% over last February.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.