CAM Investment Grade Weekly Insights

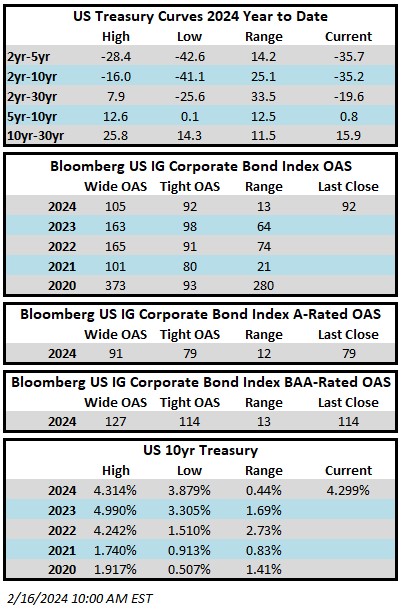

Credit spreads are back at the tightest levels of the year. The Bloomberg US Corporate Bond Index closed at 92 on Thursday February 15 after having closed the week prior at 95. The 10yr is trading at 4.30% this Friday morning after closing last week at 4.18%. Through Thursday, the Investment Grade Corporate Index YTD total return was -1.63%.

Economics

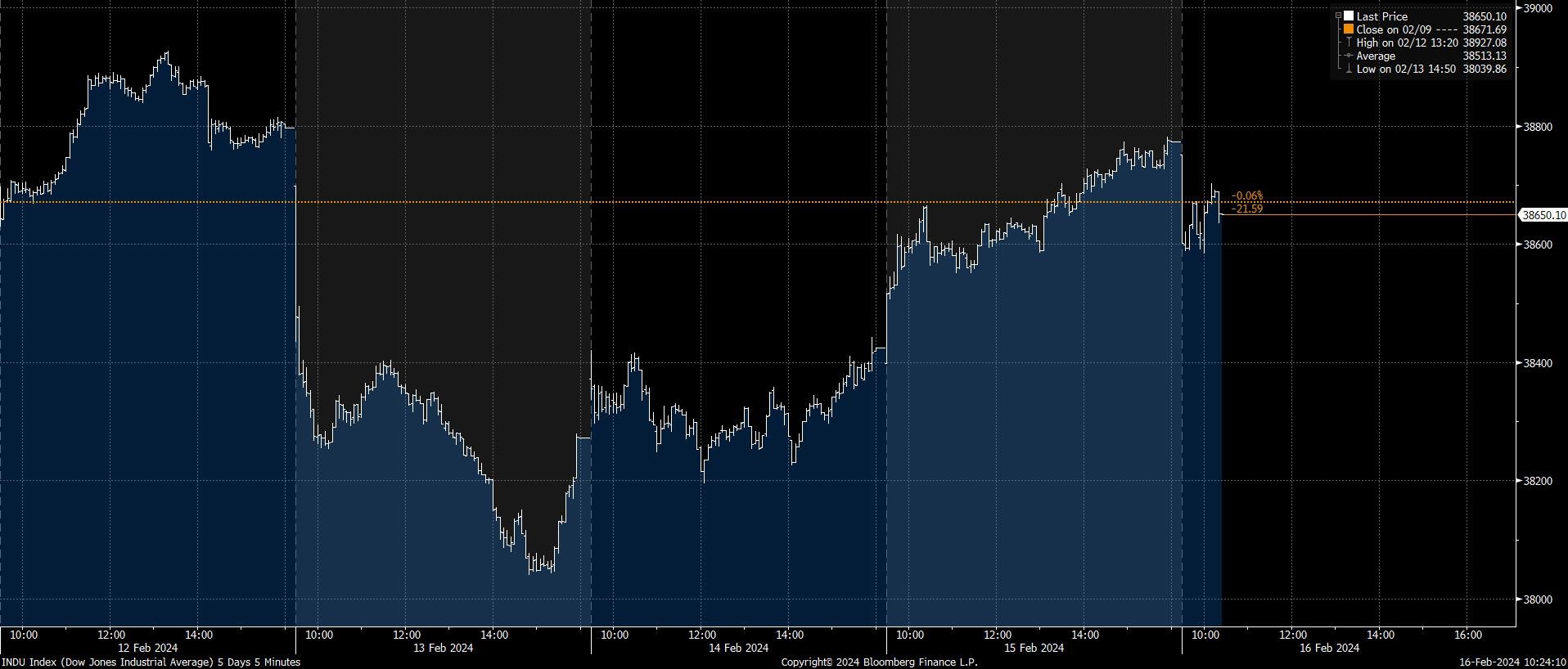

There was a boatload of data this week and it resulted in volatility in equities and Treasuries. The three major highlights are as follows: first, CPI came in hotter than expected on Tuesday morning which sent rates higher and stocks lower. Thursday morning was for the doves as retail sales data came in much weaker than expected –this sent rates lower. Finally on Friday morning, a data release showed that the producer price index rose more than expected. The PPI release sent rates to their highest levels of the week and stocks had a modestly negative reaction. At the end of the this note we have attached a weekly price graph of the 2-year Treasury as well as the Dow Jones Industrial average to illustrate some of the volatility that occurred in those markets during the week. As far as investment grade credit was concerned, the asset class fared well during the week as spreads shot tighter but there is a cautious tone in the market amid higher Treasury yields as we go to print this Friday morning. Next week is a holiday shortened week that is light on economic data. We are of the mind that the price action this week was ultimately helpful as we felt that there was far too much consensus from market participants on imminent rate cuts at the March meeting. The economic data has served to all but squash the prospect of a cut at the March 20 meeting and now we are seeing much more reasonable estimates from market prognosticators that the first rate cut may be delayed until the May, June or July meetings. We still don’t think it is a lock that the Fed cuts rates at all this year and we cannot discount entirely the possibility that inflation data remains sticky, pushing the first cut into 2025 and thus increasing the odds of a landing that isn’t necessarily hard but certainly isn’t soft.

Issuance

It was another active week for issuance as borrowers priced more than $37bln in new debt. Bristol Myers led the way as it printed $13bln across 9 tranches to fund its acquisitions of Karuna Therapeutics and Rayzebio. Next week is expected to be especially busy even despite the fact that the market is closed on Monday. Estimates are calling for as much as $45bln in new debt when the market reconvenes after Presidents Day.

Flows

According to LSEG Lipper, for the week ended February 14, investment-grade bond funds reported a net inflow of +$2.28bln. This was the ninth consecutive weekly inflow for IG funds.

U.S. 2 Year Treasury Last 5 Days:

Dow Jones Industrial Average Last 5 Days:

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.