CAM Investment Grade Weekly Insights

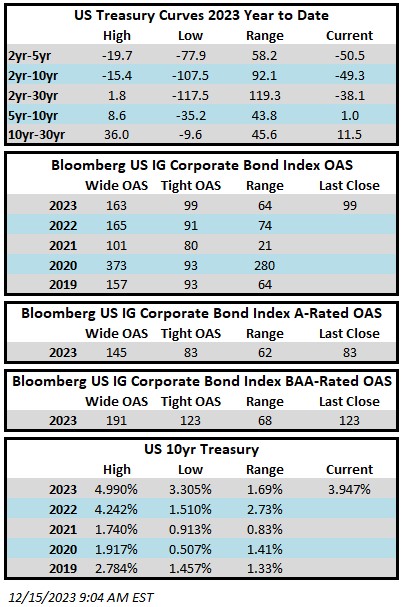

Credit spreads will finish the week on a strong note after closing Thursday evening at their tightest levels of 2023. The Bloomberg US Corporate Bond Index closed at 99 on Thursday December 14 after having closed the week prior at 105. The 10yr is trading a 3.947% as we go to print Friday morning, which is a 28 basis point move lower from its close the week prior. Through Thursday, the Corporate Index YTD total return was +8.13%.

Economics

It was an action packed week for economic releases but nothing impacted the market more than the FOMC and Chair Powell’s press conference on Wednesday. The Fed was meaningfully more dovish than expected in its messaging and risk assets were happy to take it and turn it into a rally for both stocks and bonds. We were surprised that Chair Powell did not take the opportunity to push back against easing financial conditions; the updated dot plot showed that the consensus view of the committee is now looking for three rate cuts in 2024 instead of two. What seems to be missing in much of media commentary surrounding this Fed release is that, while the dot plot is reasonably accurate over short time horizons of 3-6 months, it has been consistently wrong in its ability to predict where rates will be over 1 or 2 year time horizons. Investors should think of the dot plot as a chart that shows where a majority of the committee members “hope” rates will be in a year or two. Additionally, while rate cuts sound great in principal it is important for investors to remember that we have come a long way in a very short period of time which increases the risk that something in the financial system will go awry (even more so than it already has). Fed Funds today are +525bps and at their highest level in 22 years. If the Fed delivers 3 cuts in 2024 amounting to a total of 75bps we are still dealing with a 450bps policy rate that is meaningfully higher than it was at any point in the past two decades. Our view remains that a higher-for-longer policy rate will eventually cause a “landing” that is not entirely soft in nature, although the timing of a recession remains extremely difficult to predict. We also do not believe that a modest recession is necessarily a bad thing. We believe that the Fed simply has to engineer some softness in the labor market in order to adequately tame inflation. While there has been progress on the inflation front and there has been some modest softening of the labor market, average hourly earnings have remained strong and the unemployment rate is still exceptionally low. Bottom line, the Fed still has more work to do and Federal Reserve Bank of New York President John Williams wasted little time on Friday morning when he pushed back against market participants, saying it’s too early for officials to begin thinking about cutting rates as soon as March:

“The market in a way is reacting very strongly, maybe more strongly, than what we are showing in terms of our projections.”

Issuance

Issuance was underwhelming this week as borrowers priced just under $2.5bln of new debt. December volume stands at $23bln which is a decent haul for a seasonally slow month. There is a chance that there could be some light issuance next week but in all likelihood the new issue calendar is close to being done for the year.

Flows

According to Refinitiv Lipper, for the week ended December 13, investment-grade bond funds reported a net outflow of -$550mm. Flows for the full year are net positive +$11.8bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.