CAM Investment Grade Weekly Insights

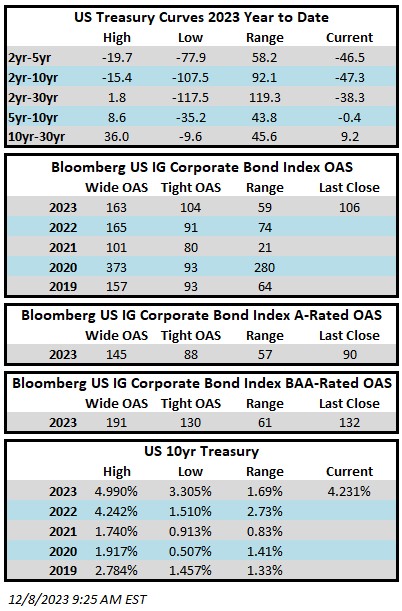

Credit spreads are poised to finish the week modestly wider. The Bloomberg US Corporate Bond Index closed at 106 on Thursday December 7 after having closed the week prior at 105. The 10yr is trading a 4.23% as we go to print Friday morning, just 3 basis points higher than its close the week prior. Through Thursday, the Corporate Index YTD total return was +5.59%.

Economics

The most meaningful data release just occurred this Friday morning with the November payroll report. It was a strong report that showed that the economy added more jobs than consensus estimates while the unemployment rate ticked lower to 3.7%. Traders had become increasingly more aligned in the belief that Fed rate cuts were eminent in the first half of 2024. This print along with continued labor market resilience in the future could bring the higher-for-longer narrative back to the forefront. Indeed, Treasury yields inched higher across the board after the NFP release. The 2yr was higher by 9bps as we went to print while the 30yr was higher by 5bps. Next week is the last big week of the year for economic data with CPI on Tuesday, the final FOMC rate decision of 2023 on Wednesday and retail sales data on Friday.

Issuance

It was a seasonally strong week of issuance as borrowers priced more than $20bln of new debt, eclipsing the high end of the estimated range. Next week syndicate desks are looking for $10bln in volume with most of that occurring on Monday.

Flows

According to Refinitiv Lipper, for the week ended December 6, investment-grade bond funds reported a net inflow of +$633.3mm. Flows for the full year are net positive +$12.3bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.