CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

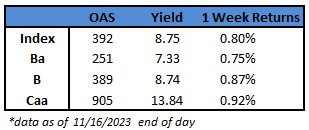

- US junk bonds are headed for weekly gains as yields dropped 18 basis points week-to-date to 8.75% as of Thursday, after 5-year and 10-year US Treasury yields sank below 4.5%, falling about 19 basis points each. Yields fell below 9% and spreads below 400 basis points since the Federal Reserve signaled, after its meeting on Nov. 1, that it was likely finished with the most aggressive rate-hike campaign in decades.

- Economic data reports this month have shown a softening labor market with a rise in jobless claims, combined with cooling inflation and an unexpected decline in prices paid to US producers, which have all reinforced market consensus that interest rates were sufficiently restrictive.

- Resilient growth combined with falling yields lured more investors into the asset class for the second consecutive week as retail funds were inundated with new cash. US high-yields funds reported a cash intake of $4.55 billion for week ended Nov. 15, after an inflow of $6.26 billion in the previous week, the third biggest on record.

- The combined inflow of more than $10b in the last two weeks is the largest two-week intake for these funds since June 2020, JPMorgan wrote.

- The US junk bond rally spanned across ratings. Robust economic data and easing rate concerns fueled November gains across all high-yield ratings.

- Junk bonds are on track for weekly gains of 0.8%, driving the month-to-date returns to 2.96%, which would be the best since January.

- BB yields tumbled 17 basis points week-to-date to 7.33%. Yields were down 66 basis points month-to-date from near 8% in October. BBs are set to post gains for the week, with week-to-date returns at 0.75%. November gains are at 3%, also the best since January.

- CCC yields have plunged 40 basis points week-to-date, the most in the high yield, to close at 13.84%. Yields tumbled 91 basis points month-to-date from near 15% in October.

- The probability of a soft landing has increased with the recent macro data driving a rally in risk assets in the past two weeks, Brad Rogoff of Barclays wrote in a Friday note.

- Cash surge and a steady rally has drawn US borrowers into the market as $4.3 billion of new junk bonds has priced week-to-date, driving the month’s volume to more than $14 billion, up 53% already from the full month of October.

- Supply is led by refinancing needs. Almost 90% of the supply is to refinance outstanding debt.

- 60% of new bonds were secured notes.

- More borrowers are expected to take advantage of lower yields and chip away at a wave of 2025 maturities.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.