CAM Investment Grade Weekly Insights

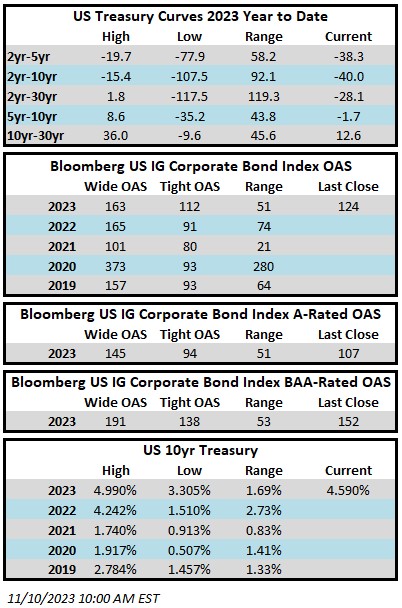

Credit spreads are looking to finish the week tighter for the third time in a row. The Bloomberg US Corporate Bond Index closed at 124 on Thursday November 9 after having closed the week prior at 125. The 10yr is trading a 4.59% as we go to print Friday morning, just 2 basis points higher than its close the week prior. Through Thursday, the Corporate Index YTD total return was +0.28%.

Economics

It was a relatively light week for market moving data. Arguably the most meaningful print of the week was consumer sentiment data that was released on Friday morning. The data showed that sentiment slipped to a six-month low but that consumer long-term inflation expectations increased to the highest level since 2011. The Fed will likely be displeased with this development as consumer views on inflation can be a self-fulfilling prophecy. Next week will be much busier on the data front with several notable releases, including the consumer price index, producer price index and retail sales.

Issuance

It was a very solid week for new issuance as borrowers printed $43.925bln in new debt, besting the high end of expectations that were calling for $40bln. In total, 30 companies tapped the debt markets during the week. Next week should be relatively active as well and estimates are looking for $25-$30bln in debt but issuers will have to navigate a busy calendar of economic data. If that data results in Treasury and/or credit spread volatility then it could make issuance more or less attractive for borrowers.

Flows

According to Refinitiv Lipper, for the week ended November 8, investment-grade bond funds reported a net outflow of -$1.48bln. Flows for the full year are net positive +$12.187bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.